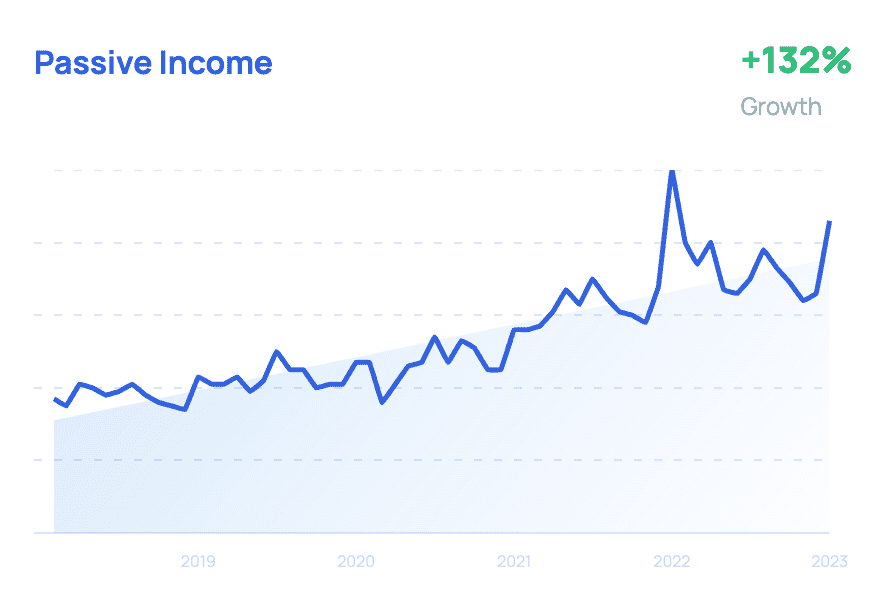

It is the beginning of a new and exciting year, a time to make financial plans to help you thrive this year. One of the trending financial goals (see chart below) is to secure passive income streams to grow your cash flow for rainy days or future investments.

According to Forbes, passive (or residual) income refers to income that you earn without actively committing a significant amount of your time or money. Passive income can be categorised into the following streams: Investing (dividends), Asset sharing (rental or sales), and Asset building (digital products and services).

5 Passive Income Opportunities to Build Wealth

1. Investing in Dividend-Paying Stock

Owning dividend-yielding stocks can be one of the most passive forms of making money. By buying shares in a company (i.e. stocks), you will at regular intervals be paid a portion of the company’s earnings/profits in the form of dividends. Exchange-traded funds, or ETFs, can be a good way for new investors to get their feet wet in the stock market. They’re easy to use and typically carry lower risk than individual stocks since a single fund holds a diversified collection of investments. Learn more about ETFs and how to invest in them.

2. Real estate investment trusts (REITs)

Investing in real estate can be a fantastic way to build passive income, but it’s not for everyone. The idea of making a hefty down payment, dealing with tenants, and managing properties can be overwhelming for some. But there’s a way to reap the benefits of real estate investing without the hassle – enter REITs. Think of REITs as companies with their own diverse portfolio of commercial properties, including office buildings, apartments, retail spaces, and hotels. REITs are known for their high dividend payouts, making them an attractive option for income-seeking investors. However, it’s important to note that REITs can vary in complexity and availability. Some REITs are publicly traded on stock exchanges, while others are not. So, before investing, it’s crucial to do your research and understand the different types of REITs available to you. Learn more about REITs and how to invest in them.

3. Buy an Already Profitable Online Business

Skip the hard work of starting a digital business from scratch and buy one that’s already making money! A lot of people start digital/internet businesses but lose interest, leaving a pool of underperforming yet potential-filled opportunities for you to choose from. Check out Flippa, MicroAcquire and Empire Flippers, two popular marketplaces for browsing available digital businesses. Empire Flippers has more established and profitable sites with prices starting from $20k to $2 million, while Flippa offers a more budget-friendly option through its auction-style format, with bidding starting as low as $1. Keep in mind, purchasing a blog requires some online business experience, so don’t dive in blindly.

4. Sell Digital Products

Cash in on creativity with digital products! Say goodbye to stock complexities and hello to a passive income stream by selling ebooks, podcasts, online courses, and stock photography. Create the product once, then sit back and watch the sales roll in. It’s a recipe for success if you’ve got the skills to whip up something amazing. Who needs a 9-5 when you’ve got digital products to sell? For instance, you can create online courses using tools like thinkific or Wix and earn income from sales, subscriptions or sign-ups. After setting up the course, with adequate marketing, you can earn a lifetime income on valuable and informative content. The deal is to create courses everyone is interested in taking and distribute them through platforms like Coursera, Udemy, and SkillShare

Unleash the talker in you with a podcast or YouTube channel! If you’ve got a way with words and a wealth of knowledge to share, consider starting your own show. Pick your niche, curate your topics, and decide if you want to feature guests. Host your podcast on platforms like SoundCloud or Anchor. Or, if visuals are more your thing, start a YouTube channel and share helpful, informative, or just plain funny videos. The more views and subscribers you get, the more cash you’ll earn. Just remember, marketing is key to success, so make sure to include it in your set-up plan.

5. Blogging

Ready to turn your passion into profit? Make your mark on the world by starting a blog on your area of expertise! Health and Fitness? Home Improvements? Eco-Friendly & Sustainable Living? Showcase your skills and create engaging content to build a following. And when you’re the go-to expert, let the sponsors come to you! Sure, it takes time and effort to build your content and audience, but the payoff can be a steady stream of income. Just be prepared for the risk: you may invest time and resources, only to find limited interest in your niche. But hey, you never know until you try!

So What is the Best Passive Income Path for You?

While this list is not exhaustive, it covers lucrative ways to start earning a passive income. Passive income awaits! Whether you’re a real estate buff or a creative mastermind, there’s a passive income strategy for everyone. Decide on your goals, budget, and available time, and pick a combination of these income streams. Whether it’s to offset the rising living costs, stack up money for emergencies, build good money habits or simply a pool of investment funds, it’s time to earn more money outside your regular income. Real estate is a highly recommended path, with 90% of all millionaires credited to real estate ownership. However, it requires a significant initial investment. For those who prefer hands-on control, entrepreneurship options like starting a blog, YouTube channel, or online store can bring life-changing wealth and satisfaction, even though they may not be entirely passive in the beginning.