Have you ever thought about why schools didn’t teach you about personal finance? You’re not alone! Most folks graduate with fancy degrees and no clue on how to manage their money. It’s weird because the point of most jobs is to make money, right? But studies show that many people don’t do so well on financial tests.

That’s where we come in! We’re going to share with you 5 financial hacks they never taught you in school. These hacks are going to help you learn the basics so you can get started with managing your money. They’re like secret tricks to help you plan for your future, save money, and make your money grow. So let’s get started on your journey to financial success!

[optin-monster-inline slug=”ctuw3bqe1phqbyhdsnlb”]

1. Differentiating bad debt from good debt

Good debt is a powerful tool, but bad debt can kill you. #richdad

— Robert Kiyosaki (@theRealKiyosaki) May 23, 2019

We are sure you have heard many times that you should stay away from debt. What they don’t add is that some debt may be needed to invest in a worthwhile financial pursuit. This is known as good debt and it may help you increase your net worth or grow future income. The truth is, nobody has all the money they need all the time. This explains why Tesla has $2 billion in debt and Apple has over $76.03 billion in net debt as of 2021. The difference is that both businesses invested the money to grow future income.

Successful people understand this principle, so they take loans to buy high-yield investment properties. They know that not all debt is bad debt. The key is to take loans that will increase your net worth and multiply your future income. Remember that borrowing for consumption or a lifestyle with no returns is always a bad idea.

2. Your credit score can make or break you

A credit score (typically between 300-850) measures your likelihood of repaying debts, based on your payment history, credit utilisation, length of credit history, and types of credit used. Lenders use it to determine whether you can access a loan or not. Many people ignore their credit scores until it is far too late. A low credit score makes the difference whether you pay more for a mortgage or access a loan.

People with credit scores below 640 are considered to be subprime borrowers. They are charged a higher interest rate, given shorter repayment tenure or stringent terms to compensate for carrying more risk.

It is never too early to work towards a high, blemish-free credit score. In fact, starting from a young age is a great way to keep your credit score ‘evergreen’. Here are a few financial hacks to get started today: become an authorised user on a family member’s credit card, apply for a secured credit card, set up automatic bill repayments and keep your credit use low. Remember, the best time to build great credit is yesterday, the next best time is now.

3. You don’t need a reason to save

Saving as a financial hack is often portrayed as something to do for a goal. This is not a bad idea, but it is better to think of it as your salary to yourself. Pay yourself first and earn compound interest on your own income by putting the money to work early. The upside to saving is that it provides emergency funds, investment capital or a long-term low-risk investment.

Most successful people understand this and apply the 20/30/50 principle to all their earnings. They split their income into 50% for needs, 30% for wants and 20% for savings. Elizabeth Warren popularised the 50/20/30 budget rule in her book, All Your Worth: The Ultimate Lifetime Money Plan.

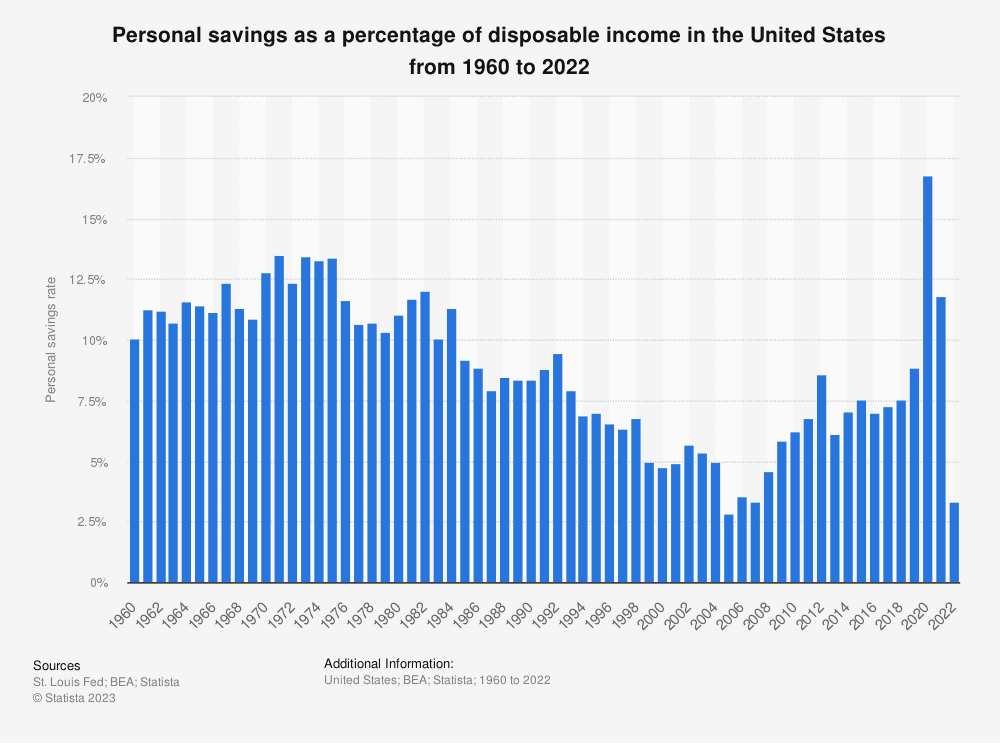

The overall debt levels in America spiked by 5.4% in 2021 and the average rate of personal savings fell below 5% in the last quarter of 2022. This indicates poor saving culture; and the habit of saving whatever is left after spending. Warren Buffet offered the best antidote and advice for this.

“Do not save what is left after spending, but spend what is left after saving.”

Warren Buffet

If you want to save money, adopt one of the financial hacks called the 20% rule. This hack is easy to remember and follow. Just put away 20% of your income each month. This will help you build up a savings fund that you can use when you need it. You can make it even easier by setting up automatic savings from your accounts. It’s like putting your money on autopilot. The more you save, the better you’ll become at managing your finances. Follow this hack and you’ll be a savings pro in no time. Let’s start building that nest egg!

4. You are your greatest asset

Many things are said to be true. Perhaps the most obvious is that the person staring back at you in the mirror impacts how far you go in life. What goes on around you is nothing compared to what happens inside of you. John Maxwell, the leadership expert calls it ‘the law of awareness’ –You must know yourself to grow yourself.

1) Elon Musk grew up reading two books a day,

— Abhijit Chokshi | Investors का दोस्त (@stockifi_Invest) August 30, 2021

2) Mark Zuckerberg aims to read at least one book every two weeks.

3) Bill Gates reads 50 books a year.

What about you?

Listen up, folks! It may sound like a broken record, but the truth is you are the secret sauce to your success. Jobs come and go, relationships may fall apart, and even the stock market can take a hit, but you’re the one constant in your life. You determine your outcome! To make a difference, start by investing in yourself. Reading may seem boring, but it’s one of the easiest ways to learn and improve your skills.

There are tons of awesome books out there on personal finance, investing, and building wealth. By diving into these books, you’ll get top-notch knowledge and strategies that can make a huge difference in your financial game. Become a valuable person by investing in getting a good education, a healthy lifestyle, quality relationships and life-enhancing habits.Trust us, investing in yourself is the ultimate financial hack!

5. You can make money outside your 9 to 5

It’s a common misconception that once you have a 9 to 5 job, you can’t earn money elsewhere. Well, we are here to tell you, that’s just not true! There are actually a ton of financial hacks you can use to make extra money on the side without messing with your regular job. And the best part? The sky is the limit when it comes to your earning potential. So don’t limit yourself, explore your options and start building your wealth today!

Successful people have multiple streams of income and even earn money while they sleep! Outside the job security of a 9-5, diversify your income streams and make your money work for you. You can earn passive income from high-performing dividends stock, property gains, crypto investments & NFTs and monetising your knowledge & skills by offering consultancy and freelance services.

If you don’t find a way to make money while you sleep, you will work until you die.

— Grant Cardone (@GrantCardone) January 12, 2023

It’s essential to know the financial hacks that can help you manage your money better. Not only will it help you with financial literacy, but it will also improve your financial health and outlook. Remember, it’s never too late to start implementing these hacks. Bet on yourself and take the first step today, and see how much of a difference it can make. Don’t be afraid to make mistakes along the way because you can always learn from them and try again. With these tips, you’re sure to become a financial pro in no time. So, what are you waiting for?