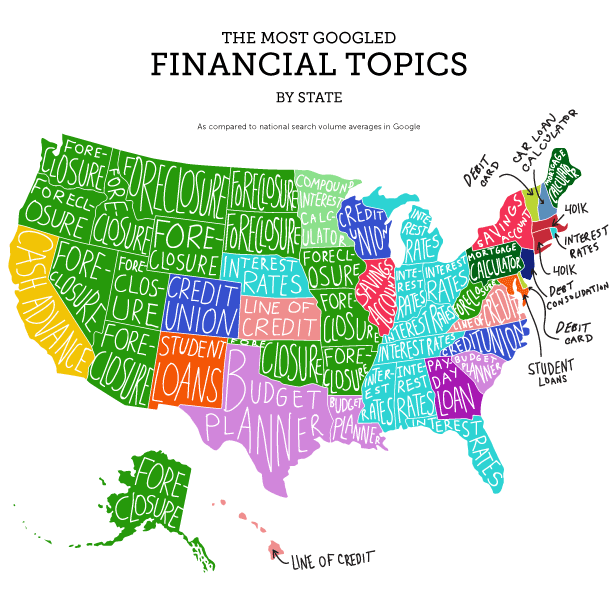

Everyday people ask Google millions of questions ranging from weight loss to financial topics. These topics shows the various financial obligations and decisions that users confront as they navigate their lives. We compiled five most searched financial topics on Google to offer insights and tips for enhanced financial literacy. Here are Google all time 5 most search financial topics and what they mean.

1. 401 (k)

The 401 (k) is a retirement savings plan offered by employers with tax benefits to employees. There are two types of 401(K) plans and both offers tax relief at varying times. The traditional 401(k) reduces taxable income hence tax is only deducted at withdrawals not before contributions are made. On the other hand, Roth 401(k) introduces tax before you make your contributions but remains tax free at withdrawals. Only the U.S currently offers this plan and it has the backing of the Internal Revenue Code (IRC), Section 401 (k) to encourage savings for retirement.

Pro Tip: Whether you are an entrepreneur, employee or freelancer, check your eligibility and start a 401(k) plan because it reduces your tax burden while saving for retirement.

2. Interest Rates

Interest rate as a financial topic is on everybody’s lips, and the reason is not farfetched. It is important for your financial health! Interest rate is the amount a lender charges a borrower for a loan. It is usually a percentage of the total amount loan and considered as Cost of Debt. IR is applicable to credit union or bank deposits which is Annual Percentage Yield (APY). Most lenders apply high interest rates to borrowers they consider risky to protect themselves in the case of a default.

Pro Tip: Your credit score which is a snapshot of your financial history is important when determining IR on loans. Keep your credit scores on away from amber lights!

3. Individual Retirement Account

An IRA is a long term term retirement savings account that offers tax incentives. This account operates parallel to the 401(k) for entrepreneurs, freelancers and self employed individuals with earned income. You can open an IRA via your bank, an investment house or a broker. The best part is that you can decide how to invest your contributions.

Pro Tip: Only earned income can be contributed to IRA, hence dividends, interest and child support cannot be contributed to the account.

4. Micro-investing

Although investment has become a commonly used buzzword, many people do not understand the practicality of it. Investments is anything your money goes into for higher return or profit. It ranges from financial instruments like shares, bonds, stocks to real estate, and even personal development. On the other hand, micro-investing is the habit of putting away little amount of money on a consistent basis while earning interest on it. This money habit over time creates a pool of fund that is useful for larger and longer term investment opportunities.

Pro Tip: Make micro-investing painless and simple by automating it. This is a sure way to build your discipline and consistency.

5. Debt consolidation

In its simplest form, this is when you move your existing debt obligations from multiple accounts into one. This usually entails paying off some loans to close out the credit accounts while maintaining a single account for all your credits. i.e, a debt consolidation loan allows you take out a loan to to refinance multiple debt obligations. The decision to consolidate your debt requires checks from the lenders who determines your eligibility for it. The long term cost of debt consolidation such as interest rates, loan tenure, and type of loan are important when making such a decision regarding debt consolidation.

Pro Tip: Debt consolidation only makes sense when you change your money habits by cutting your spending and saving more to get back on track.