As an immigrant/expat in the United States, life can be a mixture of the good, the bad, and the confusing. You are far from a community you’ve probably known all your life and in an environment with a different set of rules. As though that is not bad enough, you must also navigate the complex tax laws.

With adequate knowledge and understanding of the system, you can take advantage of deductions and credits that can significantly reduce your tax liability. In this article, we provide tips on maximising deductions and credits.

Understanding the US Tax System

Just did my own taxes. I should be in jail by the morning

— Dan Kaufman (@D_Kauf11) February 21, 2021

The US tax system considers federal and state institutions, meaning federal and state laws are applied in income taxation. However, they are treated as autonomous entities with separate jurisdictions. Additionally, within each state, several other jurisdictions (such as counties or towns– these taxes are referred to as municipal taxes) have separate tax laws hereby highlighting the complex nature of the US tax system. For instance, some counties charge school and state taxes, while others do not.

The US income tax system has a structure consisting of;

- Federal Personal Income Tax (here, US residents and citizens pay federal income taxes on their income, including money earned abroad), and

- Corporate Income Tax (corporations operating in the United States pay taxes on their net income [revenue minus expenses]).

Income in the United States is progressively taxed, meaning the higher you earn, the more tax you pay. You end up paying no tax if you make very little; decent incomes pay a fraction in taxes, while high earners pay relatively more. The system design strives to provide a balance in the income scales.

Pro Tip: All money earned in a year, from wages and salaries to lottery or gambling wins, is considered income, is to be reported, and will typically be taxed. However, profits from buying and selling stocks/shares aren’t considered income. Instead, they are referred to as capital gains. Capital gain taxes are half the income tax rate, giving you a great chance to build wealth while paying less in taxes.

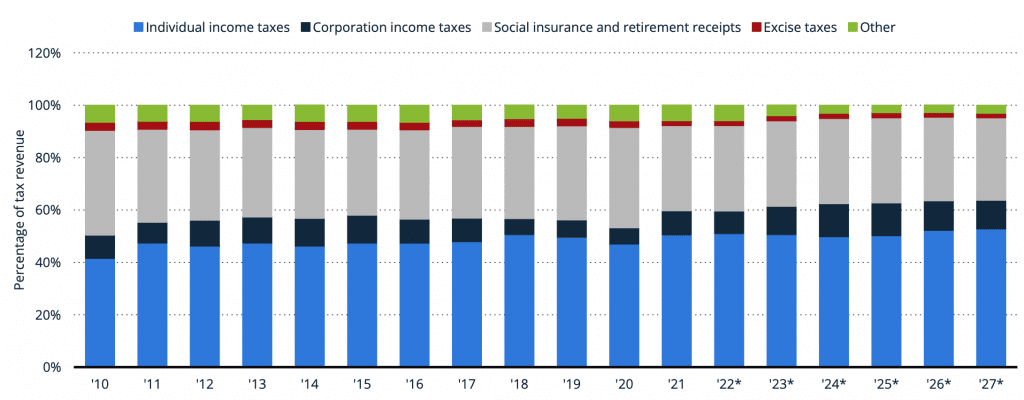

US Tax Categories

A key feature of the US tax laws is that it requires immigrants to pay the same taxes as citizens. These include but are not limited to the following:

- Federal income tax: a tax based on individuals’ income used to fund the government’s general operations and services.

- State and local taxes: These taxes by state governments vary by state and can include taxes on income, sales, and property.

- Social Security and Medicare taxes: these are also known as payroll taxes and are deductions from income used to fund the Social Security and Medicare programs.

- Excise taxes: Apply to specific goods or services, such as gasoline or cigarettes.

- Business taxes: If you own a business as an immigrant, you may be required to pay taxes on the income your business generates or the goods or services you sell.

Depending on your location and jurisdiction, other taxes may apply, you can find details on the US government’s official website or the Internal Revenue Service website.

While you may be paying the same taxes as a US citizen, the difference lies in your obligations and filing requirements. It is important to note that you only become a US citizen and are treated to their tax requirements after you may have received your green card. Keep yourself updated with key deadlines and forms.

Maximise your deductions and credits

A tax deduction helps lower your taxable income (how much of your income can be taxed). For example, if you earn $70,000 annually, tax deductions can help reduce your tax liability to $66,000 instead, reducing that tax you’d have to pay.

On the other hand, tax credits represent a reduction in what you owe as taxes, dollar-for-dollar. To explain more clearly, suppose you have just qualified for a tax credit of $2,000; your total tax owed would reduce by that $2,000. If you were due $500 in taxes and received this type of credit, you would get a tax refund of $1500 ($2000 less $500).

The first step in maximising your deductions and credits is understanding your filing status. Factors such as your marital status, dependents, and other factors determine your filing status, rate, standard deduction, and eligibility for certain credits and deductions.

Five filing statuses: single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child.

It is crucial to choose the correct filing status, as it can have a significant impact on your tax liability. Here are 8 of the most overlooked tax credits and deductions you can take advantage of as a U.S. expat.

1. Earned Income Tax Credit

EITC is a refundable credit that helps low to moderate-income workers, and their families get breaks or reductions in taxes. You may also get an increase in your tax refund with the EITC.

To qualify for the EITC: You must not be a non-resident alien; You must possess a social security number; You must be able to work in the U.S.; You must not be filing Form 2555 (Foreign Earned Income), amongst others. Find out more qualification metrics here.

2. Child Tax Credit

You can claim this credit, even if you don’t typically file tax returns. As the name implies, it provides tax breaks to individuals and families with qualifying children. For children between 5 and younger, a maximum credit of $3,600 per child applies, while for children between 6 and 17 years, a credit of $3,000 applies per child.

3. Lifetime Learning Credit

This credit applies to individuals enrolled in college, professional certification courses, or ESL studies. If you qualify for the LLC, you can get up to $2,000 for each tax return. To claim the LLC, however, you must have spent at least $10,000 in education fees in 2021/2022. Your annual income must also be under $69,000 ($138,000 if you file jointly with your spouse).

4. Claiming dependents/Dependency Exemption

You can also claim credits on dependents or qualifying relatives on your tax return if you have children under 19 or 24 (for full-time students only) or any relative who earns less than $4,300 a year. Also, if you provide more than half of an individual’s total annual support, they qualify as a dependent. You should list them in your return. You’re entitled to a nonrefundable credit of up to $500. To claim this credit, follow the instructions provided by the IRS.

5. Tuition Deduction

If you are paying tuition for a dependent, spouse, or yourself, you could be eligible for a tuition deduction. These are deductions of up to $4,000 from your income to help you cover higher education costs.

Your gross income should be about $65,000 or less to qualify for this deduction. If you file taxes with your spouse, this amount is $130,000). It is important to note that this deduction only covers tuition expenses (room, board, or course-related supplies are not covered). You can find out more information on tuition deductions here.

6. American Opportunity Tax Credit

This tax credit can help you pay for education-related expenses incurred in the first four years of education after high school. You can get up to $2,500 per student. You could also get refunds of up to 40% (maximum amount of $1,000) if you don’t owe any taxes.

7. Rideshare and Delivery Deductions

Suppose you work for a ride-hailing or delivery service (e.g. Doordash, Uber, Lyft). In that case, there are several deductions the IRS qualifies you for, such as deductions for vehicle and operating expenses.

Items included in these deductions typically include fees and commissions paid to your company, tolls, provisions for passengers (such as snacks), and sometimes expenses for your cell phone plan. There is also the IRS standard mileage deduction as deductible costs. The current rate for miles driven for business purposes is 58.5 cents per mile*

*Note: You must track your miles, or you won’t be able to take advantage of this deduction

8. Tax credits and deductions for remote workers

The COVID-19 pandemic forced many businesses to adopt remote work to keep up with business activities. Tax reforms sometimes let employees take federal tax deductions for work-from-home expenses. However, that is no longer the case. While you can not make federal tax deductions to your remote work expenses, some state tax laws require employers to repay employees for any business expenses. These laws sometimes allow employees to deduct unreimbursed expenses on state returns.

If you’re self-employed, you can also take advantage of work-from-home expenses. Self-employed business owners can make deductions of up to $1,080,000 for purchasing business equipment, such as computers, office furniture, and printers. However, the amount deducted is limited to your business’s income.

Alternatively, you can take the home office deduction, which allows you to deduct specific home expenses (such as customer supplies, ink, paper, or other stationery) from your taxes. To qualify for this deduction claim, you must use a part of your home (or a structure on your property) as your primary place of business. Expenses under this consideration include rent, real estate taxes, utilities and insurance, mortgage interest, and painting and repair costs for your home office.

Bottomline

Navigating the U.S. tax laws and staying on top of your taxes as an immigrant can often be challenging, but it doesn’t have to be. By planning early and staying informed with the best tips and strategies from trusted sources, you can maximise your earnings, reduce your tax liability and prosper in these times. You must work with a qualified tax professional who can guide you through the process and ensure that you comply with all of the tax laws and regulations.