Putting money in a bank account might feel safe, but gold offers more value. Learn why and how to start investing in gold, even from Nigeria.

When prices rise and money loses value, people start to look for safety. For years, gold has offered that safety. Now, more than ever, people and governments are buying gold again. From central banks increasing their reserves to everyday people looking for safe investments, gold is making a comeback. The question is—should you be paying attention? And quite frankly, you should.

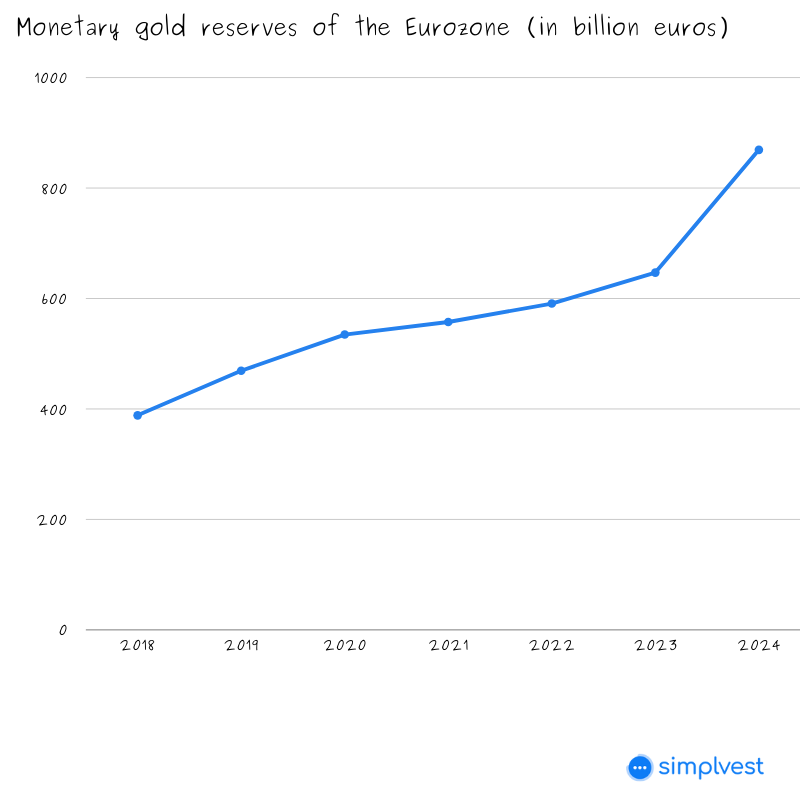

With the U.S. actively devaluing the dollar to boost exports and the Eurozone increasing gold reserves by 35% in a year, it’s clear that those in power see something coming. But what does this mean for you? If you’ve been keeping your money in the bank or stacking dollars under your mattress, it might be time to rethink your strategy. Here’s why gold could be your best bet—and how to invest even if you’re in Nigeria.

Why Gold? Follow the Smart Money

Gold is more than a pretty metal. It holds value when cash does not. But you already knew that. You may not have known, however, that gold has a finite supply, unlike fiat currency, which governments can print at will (hello, inflation). That’s why people and institutions rush to buy it in times of uncertainty.

Look at the numbers: Eurozone central banks increased their gold holdings by 35% last year, way above the previous five-year annual maximum of 10%. Why the sudden rush? When currencies weaken, gold holds its value.

Historically, gold has always been a hedge against inflation, currency devaluation, and financial crises. When economies struggle, gold prices tend to rise. And with the U.S. openly working to devalue the dollar, those who hold gold could come out on top.

In simpler terms, The U.S. is pushing the dollar down on purpose, so investing in gold may help you stay ahead.

How Do You Invest in Gold?

Now, you might be thinking: That’s great, but how do I actually invest in gold? The good news is that you don’t need to buy bars of gold and bury them in your backyard (unless you want to!). Here are a few practical ways to get started:

1. Gold ETFs (Exchange-Traded Funds)

Gold ETFs are one of the easiest ways to invest in gold without physically owning it. These funds track the price of gold and allow you to invest just like you would in stocks.

- International platforms:

If you have access to investment platforms like Hargreaves Lansdown, eToro, or Trading 212, you can buy gold ETFs such as SPDR Gold Shares (GLD) or iShares Gold Trust (IAU).

- Local platforms:

Nigerian fintech companies like Bamboo and Chaka give you access to international markets where you can invest in these ETFs. Stanbic IBTC Stockbrokers is also a great resource.

2. Gold-Backed Digital Assets

With the rise of cryptocurrency, some platforms now offer gold-backed digital tokens. These represent real gold stored in vaults, and you can buy or trade them like crypto.

- Popular options include Paxos Gold (PAXG) and Tether Gold (XAUT).

- You can buy them on crypto exchanges like Binance or Kraken.

3. Buying Physical Gold

For those who prefer a tangible asset, you can buy gold coins, bars, or jewelry. Some reputable gold dealers in Nigeria include:

- Jide Taiwo & Co. (for gold bars)

- Local gold markets in Lagos, Abuja, and Kano

- Online marketplaces (just be wary of scams—always verify sellers!)

4. Gold Mining Stocks

Another indirect way to invest in gold is through gold mining companies’ stocks. Some major players include:

- Barrick Gold (GOLD)

- Newmont Corporation (NEM)

- AngloGold Ashanti (AU), which operates in Africa

These stocks often move with gold prices, offering potential profits when gold rises.

Why Keeping Your Money in the Bank is a Losing Game

Think your bank is keeping your money safe? Think again. A recent report showed that Zenith Bank made ₦1.3 trillion in profit in 2024, but guess what? A chunk of that came from using your deposits to generate revenue.

Banks lend out your money at high interest rates while giving you meager returns (sometimes as low as 2% annually). Meanwhile, inflation eats away at your savings, making your naira worth less every year.

So, while your money sits idle, the bank is using it to grow. Why shouldn’t you do the same? Investing in gold and other vehicles give you a chance to fight inflation and protect your wealth.

The Big Picture: Should You Invest in Gold?

Gold isn’t just for central banks and billionaires. With the right tools, everyday Nigerians can get in on the action. The goal isn’t necessarily to replace all your savings with gold but to spread your risk.

If you’re worried about inflation or weak currencies, gold is a strong hedge. Whether you buy ETFs, digital tokens, mining stocks, or physical gold, there’s an option for everyone.

Time to Take Action

We’re in a time of economic uncertainty, and the moves you make today will determine your financial future. If central banks are investing in gold, maybe you should consider it too.

Start small, do your research, and take control of your wealth. The worst financial decision is doing nothing at all.

Are you ready to make your money work for you?