It’s everywhere on the news: CBEX has crashed! Nearly a billion dollars gone! Unfortunately, it is not the first and won’t be the last.

ICYMI: The Story of CBEX and Its Collapse

On Monday 14th, April 2025, Nigeria was rocked by news of collapse of CBEX. Until then, many people had not heard of the ‘digital asset trading platform.’ However, with over ₦1.3 trillion (approximately $809 million) gone from investors’ accounts, it was clear that a lot of people knew. More than that, an estimated 300,000 Nigerians had invested their money with them.

The platform began operations around July 2024, gaining fast traction through viral social media hype, word-of-mouth testimonials and emotional success stories shared by ‘investors’ on WhatsApp, TikTok and X. Of course, the current economic turmoil, rising inflation and unemployment played a huge role in CBEX’s rise.

The origins of CBEX are not clear. CBEX, supposedly stands for “Centralized Blockchain Exchange”. CBEX also stands for China Beijing Equity Exchange, a platform owned by the Chinese government and used for mergers, acquisitions and restructuring of state-owned enterprises. This could have been part of the ruse, where CBEX used a name that provided it with some vague connection to the Chinese government.

On the 1st of February 2024, the legitimate CBEX issued a statement disassociating itself from ‘an overseas cryptocurrency firm sharing its abbreviated English name, CBEX Group.’ In the statement, CBEX clarified that it had never been involved in any trading activities associated with cryptocurrencies or other virtual assets.

Despite claiming to be registered in Canada as well having ties to the legitimate China Beijing Equity Exchange, CBEX was unregistered in Nigeria and Canada. SaharaReporters ran a check and found no verifiable records of any such companies in Canada to support CBEX’s claim of being a registered Canadian company.

CBEX is trending because it has officially crashed. [Explained + Video]

— Trending Explained (@TrendingEx) April 14, 2025

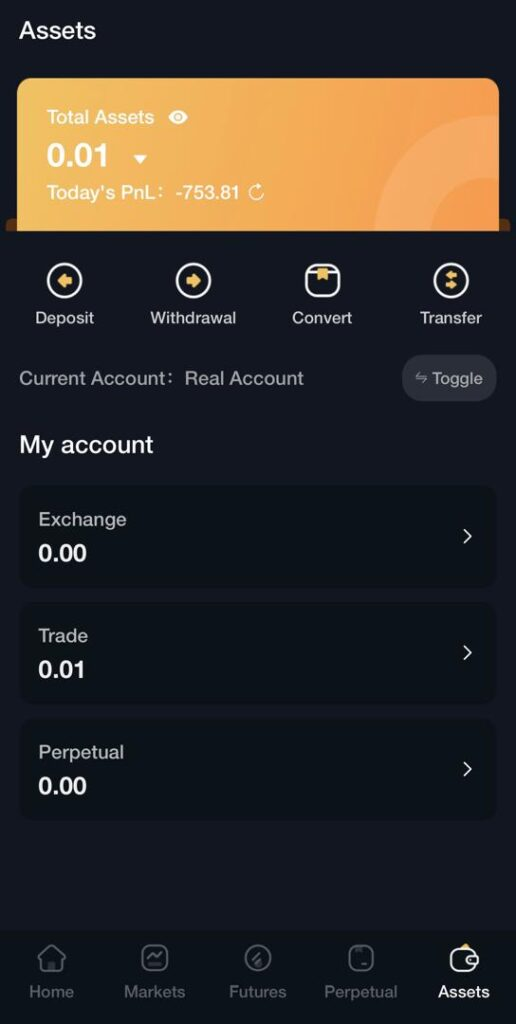

Today, they moved $822,852,811.66 (₦1,337,021,554,889.20 trillion) into a private ETH wallet, as users funds dissapeared from their wallets and turned to 0.00.

Fun fact, the funds disappeared immediately… pic.twitter.com/x2P2vWkoBv

How the Collapse Happened

On Monday April 14, 2025, CBEX abruptly halted withdrawals, citing a “security breach.” On the 9th, some users of the platform began to report being unable to withdraw their funds. They were assured that withdrawals would resume on Tuesday, the 15th. But on Monday 14th, investors found their account balances reduced to zero. When they reached out to the platform’s Telegram channels, they were told that the problem was the result of a hack. They were also given assurance that things will be resolved soon.

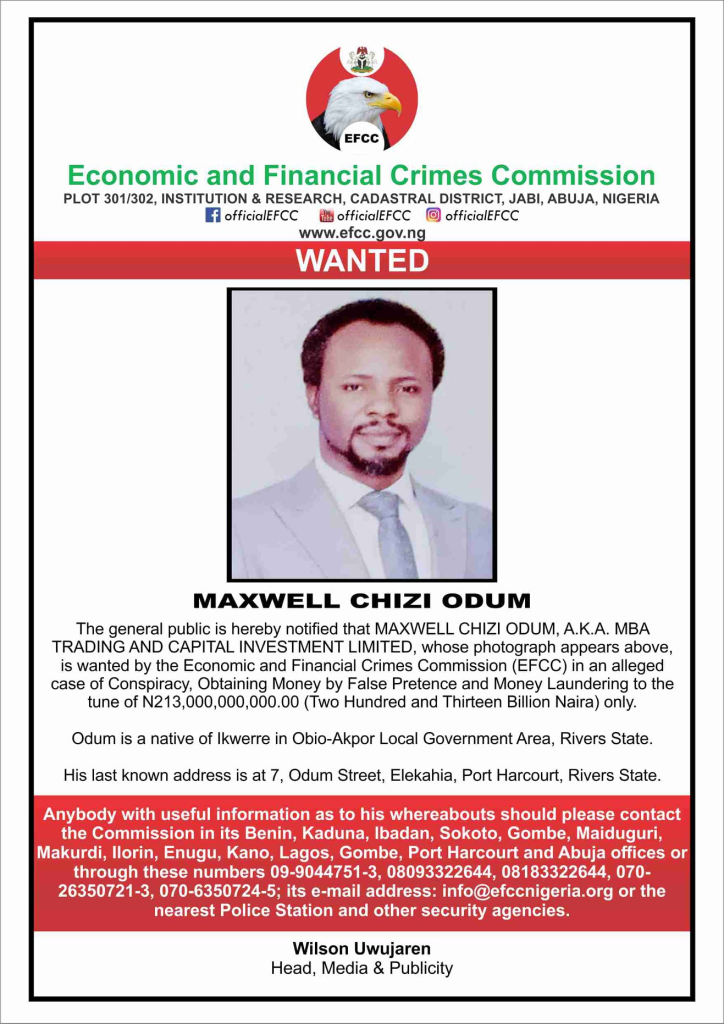

To extort even more money from beleaguered investors, CBEX began demanding $100-$200 “verification fees” to unlock withdrawals. Cryptocurrency expert Taiwo Owolabi revealed that the funds had been moved to a central wallet holding over $857 million in USDT. Soon, the channels were locked and the company entirely stopped communicating with its investors. The investors would storm CBEX offices in Ibadan and Lagos and loot furniture and equipment in protest. The EFCC announced that it had launched an investigation but this is mostly medicine after death.

All the Red Flags Were There From the Beginning

CBEX marketed itself as a secure platform for trading cryptocurrencies, tokenized commodities and other blockchain-based financial instruments. It promised of 100% returns on investment within 30 days, essentially giving itself away as a Ponzi scheme.

The platform also incentivized aggressive recruitment and offered bonuses for bringing in new users. Some of its packages required at least 12 referrals to be able to withdraw profits. CBEX’s operations were also shrouded in deception. It mimicked the branding of established exchanges like ByBit and used in-trend tech jargon like “AI-driven trading” and “blockchain” to create an illusion of credibility.

CBEX also had no identifiable owners or executives listed. When convenient, it displayed fake alerts and withdrawal records to mask issues with liquidity. The platform was not registered by either the SEC or CBN, both of whom continue to warn Nigerians against investing in unsecured securities. It falsified relationships with more established organizations. All these were red flags that were all ignored.

CBEX Is Just One In A Long List of Ponzi Schemes

Nigeria has a long history with Ponzi schemes. There were 1980s “wonder banks” like Umana-Umana and Nospecto. A decade ago, the infamous MMM collapsed in 2016-2017, with over three million Nigerians losing money on the platform. Following MMM were schemes like Twinkas, Racksterli, Titan Farms and MBA Forex swindling ₦231 billion alone. The Nigeria Deposit Insurance Corporation estimates that a whopping ₦911.45 billion was lost to Ponzi schemes over 23 years by 2022.

The culprits are easy to identify. They include weak regulations around securities, a general lack of financial illiteracy among Nigerians and a get-rich-quick culture. The Investments and Securities Act 2025, signed by President Bola Tinubu, gives the SEC’s authority to prosecute such schemes. But what difference would it make? The roots of the problem run deep.

Our addiction to get-rich-quick schemes is going to invite even more scammers. Economic challenges would inadvertently provide fertile ground for fraudsters. All these are compounded by our lack of robust financial education, meaning that Nigerians will continue seeking shortcuts. CBEX isn’t the last we have heard of Ponzi schemes.

SimplVest does not just preach the need to get financial education, our monthly2K course can get your started towards financial freedom.