Investing in Germany can be attractive for domestic and international investors as it has many investment options. However, navigating the German investment landscape can be complex, with unique tax structures that may differ from your country of origin.

As a business magnate once said:

“Never invest in a business you cannot understand.”

Warren Buffett

This sentiment applies to investing in Germany, where knowledge of the local regulations is essential to maximize returns and minimize risks. This article will explore various investment strategies and options available to investors in Germany and what they entail.

INVESTMENT OPTIONS FOR EXPATS IN GERMANY

There are many kinds of investment options you may select from in Germany. Some of them are:

SAVINGS ACCOUNT (SPARKONTO)

Investing in a savings account is an excellent option for those with little money to invest and who are okay with having moderate returns. Of course, a reasonable return means fewer risks, which is ideal for those with low-risk tolerance.

There are two types of savings investment accounts you may own in Germany. One is an instant savings account known as Tagesgeldkonto in German. With an instant savings account, you can deposit and withdraw money without penalty or fees, making it a flexible option for short-term investments. The interest in it, however, depends on market volatility and may vary from time to time.

The second type of savings investment account is a fixed deposit account (Festgeldkonto). With a fixed deposit account, you can deposit a set amount of money for a set duration, usually between one month and several years.

The significant difference between this and an instant savings account is that interest is static and usually higher. However, it’s vital to carefully consider your financial needs before committing to a fixed deposit account because early withdrawals will incur fees or result in a loss of interest.

STOCKS

Investing in stocks is one great option to select from. The Frankfurt Stock Exchange, the German stock market, offers various stock options, including individual equities and investment funds.

Individual stock investment is when you place all your money in a single stock, such as a share in a prominent corporation. Therefore, conducting thorough research on a company, its financial health, and its management is necessary. All you need to start is to open a brokerage account with a German or international online broker.

The second offer, investing in an investment fund, is an investment where you invest money with an institution that, in turn, buys shares with it. This type of investment can offer you a diverse portfolio of stocks/assets managed by qualified managers.

As we previously covered, the truth is that directly investing in individual shares is risky, and for a beginner, that’s not the wisest way to start. Index investing, on the other hand, is a much smarter option.

$100,000 in a bank account earns less than $100 per year,

— Andrew Lokenauth | TheFinanceNewsletter.com (@FluentInFinance) March 19, 2022

$100,000 invested in an S&P 500 index fund can earn over $10,000 per year.

You cannot save your way to wealth, you must invest.

The wealthy understand this.

REAL ESTATE

Real estate investment in Germany is another option for local and immigrant investors. One of the benefits of investing in German real estate is the country’s low-interest rates, which make it easier for investors to obtain financing for their purchases. The interest rates on mortgages are as low as 1-2%.

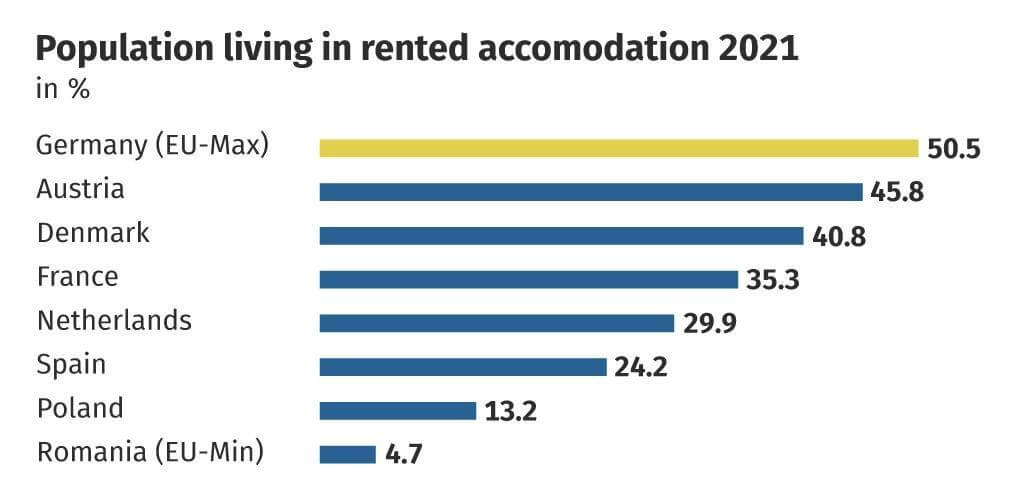

Additionally, Germany has a solid rental market, enabling investors to generate steady income from their properties.

You should also note that if you’ve owned your investment property for ten years and sold it, you are exempt from the 25% capital gains tax.

To get started with this, you must work with a local real estate agent to navigate the regulations and ensure a successful investment.

People who keep giving the advice "Don't buy a house, rent is best" are missing a few basic principles of human psychology

— Bandi Shreyas (@BandiShreyas) March 31, 2023

YES mathematically renting works out cheaper than buying but the bigger point is not always about efficient returns

Real estate has created more wealth…

PRIVATE PENSION PLANS INVESTMENT

In Germany, there are private pension plans one may invest in. The two types of private pension plans are the Riester-Rente and Rürup-Rente.

The Riester-Rente is a private pension whereby you get a government bonus yearly on your investment. There is a regular bonus of €175, while individuals under 25 years investing in this get a first-time bonus of €200. The Riester- Rente requires you to invest at least 4% of your income annually, and you begin receiving your money at age 62.

On the other hand, the Rürup-Rente is a pension plan where contributions are tax-deductible with a maximum amount of €24,100. Investing in it guarantees you a lifelong pension payment, and funds are protected from legal claims.

WHAT IS THE RIGHT INVESTMENT FOR YOU?

It is crucial that you consider certain factors before selecting an investment. For example, consider a savings account investment if you do not plan to stay in Germany long. On the other hand, if you plan to reside there for quite a while, you may consider real estate or retirement investments.

Likewise, your budget is also a determinant of your suitable investment. Low-budget investments like the savings account are an excellent fit for a small budget. Higher budget investments may come with higher risks but hey! Like Benjamin Graham, in the famous Intelligent Advisor book, said

“The investor who permits himself to be worried by unjustified market declines in his holdings is perversely transforming his basic advantage into a basic disadvantage.”

TAX IMPACTS OF INVESTING IN GERMANY.

Investing in Germany can have various tax implications. An example is capital gains tax, which is applicable when selling securities, shares, or other investments. The tax rate is as high as 25% of whatever you profit from trading. There are also dividend taxes applicable when you receive dividends from German companies. You will be subject to a withholding tax of 25% for this.

It is highly recommended to get the advice of a tax advisor to guide you through the tax implications when investing in Germany.

BOTTOM LINE

Investing in Germany as an immigrant can be a great opportunity, but it’s essential to understand the investment options, tax implications, and currency exchange rates.

Tax implications can differ for immigrants, and currency exchange rates can impact returns. It’s essential to seek financial advisor guidance and understand the risks involved. This information is for general informational purposes only and not intended as investment advice.