The “buy vs rent” debate is as old as the tale of “The Beauty and the Beast.” The argument almost always ended with a leaning towards buying, but is that still the case?

The current state of the Canadian housing market is characterized by hiked prices and uncertainties. According to the Statistics of the Canadian Real Estate Association, the average cost of a home is now $716,000.

As a result of the shocking prices, many people are turning to rentals, causing an increase in rental prices as well. However, there are predictions that the cost of houses will drop sometime in 2023.

So, come with us as we deep-dive into the pros and cons of buying and renting. We will also look at the different factors that may affect your choice.

Benefits of Buying a Home

Real estate investing, even on a very small scale, remains a tried and true means of building an individual’s cash flow and wealth.

Robert Kiyosaki

Automatic Savings Plan

If you typically experience rainy days soon after you put money in your savings, consider buying a home. When you become a homeowner, a savings plan is imposed on you in the form of home equity.

Home equity is the portion of your home that belongs to you. It’s the price difference between what is left of your mortgage payment and the current market value of your home.

In addition to reflecting the portion of your home that is yours, it can be helpful in many other ways. They include sorting out renovation bills, paying college tuition, or even getting it as cash.

Potential Source of Income

As a homeowner, you can choose to rent part of your space to generate rental income. You can revamp your garage space and rent it out to someone you know or on sites like Airbnb.

Tax Deduction Benefits

The Canada Revenue Agency provides several categories of tax deductions for people in different circumstances. These tax benefits include the First-Time Home Buyers’ Tax Credit, the Home Buyers’ Plan and Home Accessibility Tax Credit.

Drawbacks of Buying

Opportunity Costs

Opportunity cost refers to missing out on the potential benefits of one thing because you chose to prioritize another. In this case, when you buy a home, you have less income to invest elsewhere.

In some situations, the homeowner may even become house poor, using most of their income for housing needs and debts.

You Are at the Mercy of the Market

The housing market experiences a lot of mood swings. It fluctuates often, influenced by mortgage rates and geographical location factors.

The market is unpredictable and challenging to analyze. So, you might have to pray the market is favourable when you need to sell. If not, your home could be listed for weeks and months without buyers.

Maintenance Costs

The day-to-day running of a home is expensive, and there is the possibility of costly and unexpected repairs and maintenance. If you rent and something breaks, you can get your landlord to fix it. As a homeowner, you have to take care of everything yourself.

Benefits of Renting

Affordability

Renting is typically more affordable, and many people can’t handle the financial burden homeownership attracts. Despite the increase in rental prices, it has yet to catch up with the purchase prices for homes in Canada.

Flexibility

A point favouring renting in the buy vs rent debate is that nothing ties to one location. You may encounter an uncomfortable situation and need to move. You may also like a change of environment; this is easily achievable with rent.

If you don’t control your environment, somebody else will.

Grant Cardone

Low Maintenance

Renting is low maintenance as there is a limited investment of time and money. You must inform your landlord of any issue or anything that needs fixing.

Drawbacks of Renting

You Are Paying Someone Else’s Mortgage

Homeownership is a big deal and commitment; buying your own can help you build equity. When you decide to rent, your money is going to someone else and going into paying their mortgage. So, you don’t own your home and are not building any equity.

You Are at the Mercy of Your Landlord

Your landlord may limit the activities permitted on the premises. They may also decide to increase the rent, sell the house, and have you move out. If you rent, your landlord calls the shots; you can often do little about it.

Relative Instability

While one of the perks of renting is the flexibility to move around, some may not subscribe to that. This peace of mind comes with owning your place. You don’t have to worry about the increase in rent or being asked to leave at any time.

How Do You Make a Decision?

Keep Up with the Housing Market

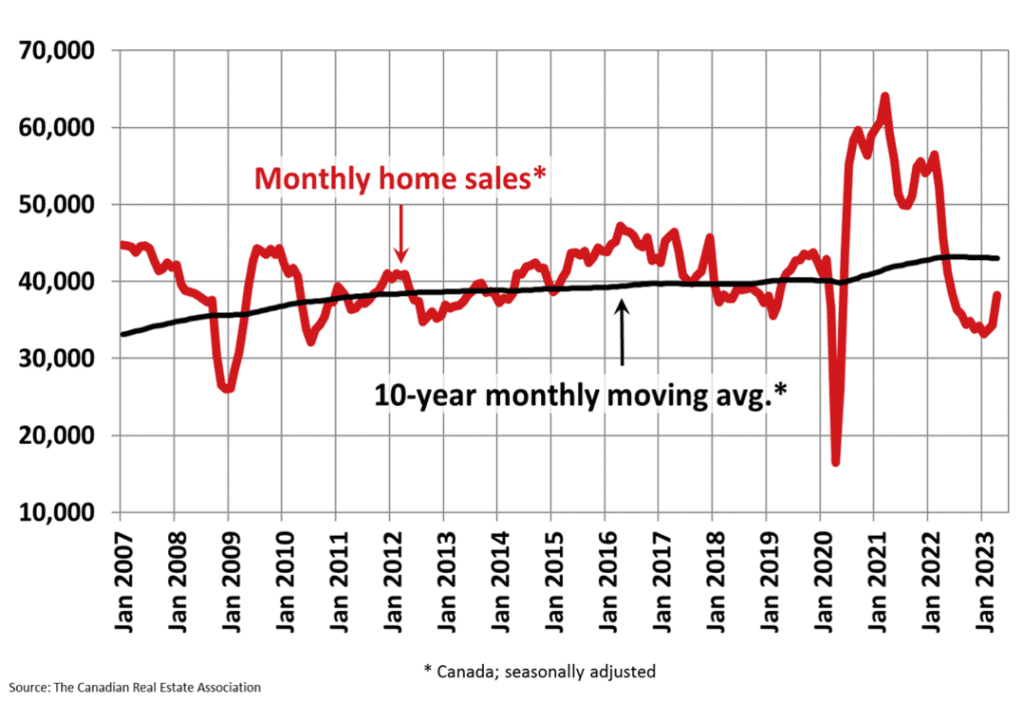

In 2022, the Canadian housing market had an upward momentum, characterized by high mortgage rates and expensive home prices. While there was a reduction in prices sometime in 2022, it picked up momentum at the start of 2023.

Despite this, home sales are increasing thanks to other forces like job markets and cheaper interest rates. However, price strain is still felt, with prices rising to $716,000 in April.

Knowing the state of the market is crucial in guiding how you approach the issue of housing in Canada. According to the market, keep up to know which is favourable at the moment.

Know Your Capabilities

Knowing your capabilities encompasses several factors. Do you have a stable job, and are you financially capable? You are well on your way if you can answer these in the affirmative.

You should also be honest in answering whether you are good at saving. This question is essential because renting allows you to invest your money elsewhere. You may be unable to do it if you buy a home.

However, it is only worthwhile if you are good at saving and investing. If this is your case, you should subscribe to the forced savings plan that comes with homeownership.

Location

Renting may be better if you want to live in places like Ontario and Toronto. It’s because the housing in those areas is expensive.

Another thing that comes into play is whether you want a luxury home with amenities like a pool or a home with basic amenities. It is better to buy utility and rent luxury.

Run the Numbers

Whether you use a rent calculator or the 5% rule, you should compare the costs of renting and buying. The 5% rule can guide you in making an informed decision.

Unrecoverable costs accrued as a homeowner yearly amount to approximately 5% of the home’s value. So, the 5% rule is that if the price of renting exceeds this 5%, renting may be an unwise decision. However, if it falls below this, you can keep renting.

Equating your monthly rental income to your mortgage payments is erroneous. It’s because you can’t recover the money that goes into paying rent. However, your mortgage payment goes to building home equity.

Key Takeaway – Buy vs Rent?

Housing markets globally, and with no exception, the Canadian housing market is experiencing uncertain circumstances with alarming hikes in prices. However, this has been projected to decrease.

So, to decide which is best for you, weigh the pros against the cons. You should watch the market to make one of your life’s most important financial decisions.