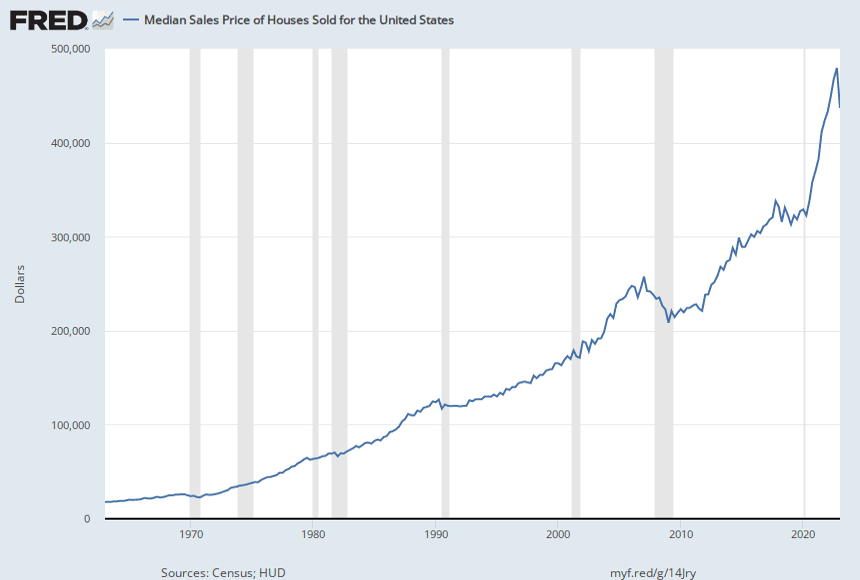

Comparing the sales price of houses in 2020 and Q1 of 2023, there has been a 32% increase. The average price of homes in 2020 which was $329,000, is now $436,800. Alarming, but the situation is mitigated for people buying their first homes since they can enjoy a first-time homebuyer discount.

As a first-time homebuyer, you can access several benefits, including government-backed programs and grants. Utilizing these benefits will bring you closer to realizing your American Dream of owning a house.

On that note, let us take you through the steps for finding your first home at a discounted price!

Understanding the Market

Market value is the price a buyer and seller agree upon for a property. Understanding the factors that impact this is crucial to helping you identify what to look out for.

Some factors that affect the prices of homes include

- Location: a home’s proximity to places and services that promote a good standard of living affects the price.

- Economy: the economy’s overall state tells on housing prices. People can afford homes if the economy is booming and the labor market is thriving.

- Size and Amenities: a three-bedroom property outfitted with excellent amenities will likely be more expensive than a smaller one with fewer facilities.

- Forces of Demand and Supply: A high demand for houses will increase prices and vice versa.

So, you should ensure to keep an eye out for these factors. They can influence your chances of getting a home at a price lower than the market value.

Research and Preparation

The heartbreaking reality of finding a home is that it is more than checking online listings and touring houses. Much research has to go into your homebuying process to secure financing and get your money’s worth.

The purchase of a residence is one of the most significant financial milestones in your life. It provides both monetary prosperity and emotional security.

Suze Orman

Conducting adequate research before purchasing a house will let you know the type of house within your budget, the financing available, and how much down payment is required.

Following research, another critical stage in your homeownership preparation is budgeting. A common mistake first-time home buyers make is shopping for a home based on what their lender is willing to give. It is best to avoid doing this as it can jeopardize your finances and make your house poor.

• Budget

— Kenny | Accent Investing (@AccentInvesting) September 7, 2022

It is a tool that gives your hard-earned dollars a job description before your feelings do.

When you prioritize your spending, it is difficult to buy unnecessary items.

A need is a necessity to live and function.

A want is a nice thing to have but not necessary.

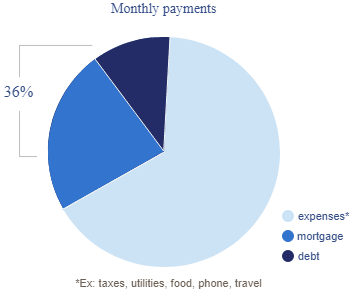

A good budgeting tip is to employ the 28/31% rule. The 28% rule states that housing-related costs should be 28% of your monthly gross income when budgeting for a home. However, according to the FHA, it is safe to allocate 31%.

However, you should not forget other expenses and calculate accordingly, to do what works best for you. You can even implement the 36% rule to cover all your debts and work through the rest. A relatively easier method is to make use of a home affordability calculator.

Knowing your required down payment, total costs, and property taxes will help with budgeting. Also, learning your non-negotiables in a home and even homeowner’s insurance will prove useful.

In all of this, you should utilize real estate apps to keep up with changes in price and new listings. You can use apps like Zillow, Realtor.com, and Foreclosure.com.

Identifying Motivated Sellers

Buying from a motivated seller is an effective way of enjoying your first-time homebuyer discount. A motivated seller is a person or entity very interested in selling their property fast due to emergencies. Their emergency may be a financial crisis, foreclosure, or personal circumstances.

These people are typically open to negotiations that may result in better prices and terms for the buyer. Indicators that give motivated seller away includes “no reasonable offer refused” in their ad or listing. It could also be that the property has been listed longer than the average DOM (days on the market).

If you need help identifying them independently, you can check on sites like HUD.gov and Equator.com. Other options include checking the local papers, attending open houses, and working with real estate agents.

Negotiation Techniques

Knowing how to negotiate is crucial to getting the best price possible for your home. It helps to have enough information on the property and the seller’s situation to negotiate confidently.

You can leverage the information acquired to make a solid offer to the seller and secure favourable terms. However, you don’t want to offer an “insulting” price so the seller doesn’t feel they’re wasting their time.

Another thing that can give you leverage is securing your mortgage loan before negotiating. It will build your confidence as well as your bargaining power.

Creating Financing Options

A conventional loan typically requires a 20% down payment. However, there are several programs aimed at giving you a first-time homebuyer discount. The US Department of Housing and Urban Development (HUD) describes people that qualify as first-time home buyers. They include

- A person has not owned a principal residence in three years. It may be your spouse. So, if you have, but your spouse hasn’t, you can buy a home together as first-time homebuyers.

- A single parent that only had homeownership in a marriage that ended.

- A person who is a displaced homemaker and has only enjoyed homeownership with a spouse.

- A person that has only owned a home not permanently affixed to a permanent foundation according to applicable regulations.

- Someone that has only owned a house that did not comply with state, local, or model building codes and cannot be brought into compliance at a cost less than erecting a permanent structure.

So, if you fall under any of these categories, you can enjoy the benefits of being a first-time homebuyer.

State Programs

Several states provide first-time homebuyer grants and low-interest mortgage programs. Sometimes, these states use this to incentivize people to relocate. These states include Illinois, Michigan, Minnesota, Ohio, Connecticut, and New York.

Government-Backed Programs

FHA loans: Federal Housing Authority is available not just to first-time homebuyers but to any purchaser. A borrower with a credit score of 580 is only required to make a 3.5% down payment. However, if you have a credit score of 500, you will need to make a down 10% down payment.

• Build your credit score

— Kenny | Accent Investing (@AccentInvesting) September 7, 2022

The modern economy runs on credit.

A good credit score is required for any loan, including mortgages, auto loans, and student loans.

Having good credit has advantages:

– Great loan terms

– Low interest

– Great odds of approval

USDA Loan: to qualify for this loan, you must reside in a USDA-eligible area. The US Department of Agriculture guarantees loans for some rural homes, requiring no down payment.

Low Down Payment Conventional Loans

Unlike conventional loans that require a 20% down payment, these require as low as 3%. Fannie Mae and Freddie Mac, federally-sponsored mortgage companies, have various programs that make a 3% down payment possible. However, these programs may require a minimum credit score of 620 and pay private mortgage insurance (PMI).

Due Diligence and Inspection

Lenders and insurance companies usually require an inspection. However, you should not treat it as a routine but as something crucial, as it can save you from headaches.

A thorough inspection will help you decide if the property is worth the investment and help you bargain properly. Due diligence will also help you know if the house meets legal requirements like zoning regulations.

It is advisable to hire an expert for the inspection to avoid missing crucial tiny detail because they know where to look.

Conclusion

The best investment on Earth is earth.

Louis Glickman

Important steps to owning your first home begin with adequate research. Other vital steps include knowing where and how to shop, securing financing, and thoroughly inspecting the property.

You can enjoy your first-time homebuyer discount by taking advantage of the market and utilizing your privilege. You can make your dreams come true using the steps outlined as a guide.