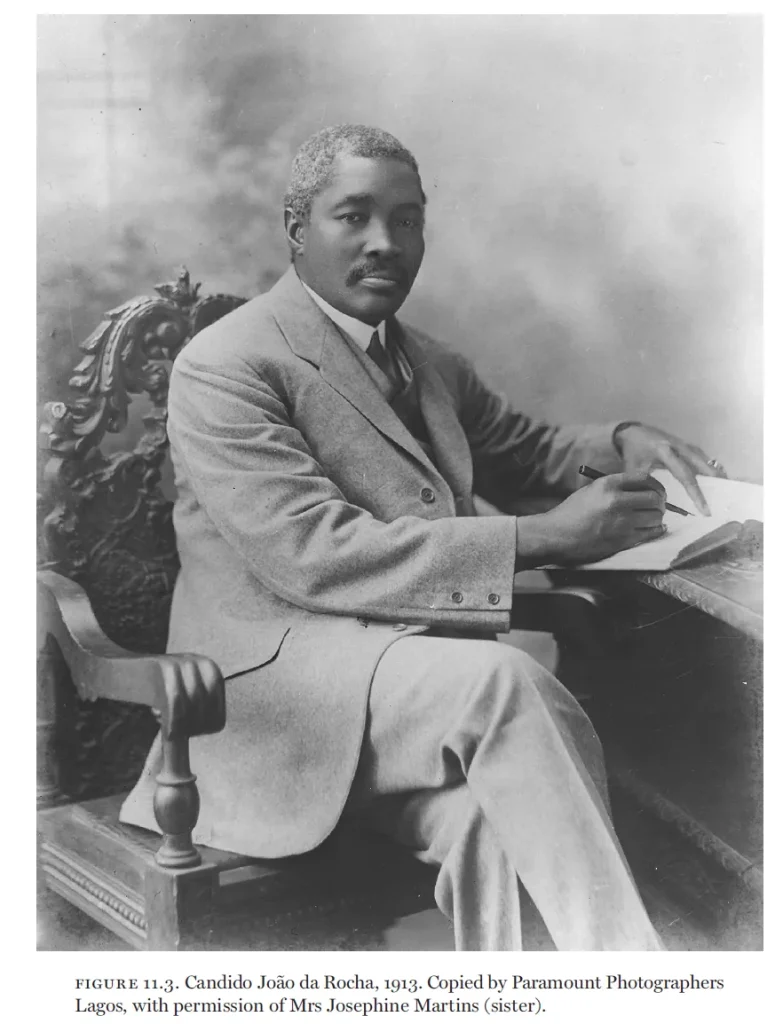

Meet Nigeria’s first millionaire Candido Da Rocha, and how his story went from one of slavery into an empire of wealth in Lagos’s budding foundations.

Hey SimplVest community,

HAPPY NEW MONTH & HAPPY INDEPENDENCE DAY!

We know it’s not always with the most cheerful of hearts that the average Nigerian celebrates Independence Day, and for very good reasons too! But, sometimes it doesn’t hurt to look at what’s come before, and how it worked, to see a maybe in what’s to come. Too cryptic? I know; I was trying to be this guy:

But I digress. Everyone’s trying to get rich these days, (no harm here), but with so many options loitering around, it’s not been as easy as it sounds. But have you ever wondered what it would have taken to become a millionaire in the 1800s? Imagine growing up in a world where opportunity is scarce, and making smart, bold financial decisions would have been like getting a camel to pass through the needle’s eye. They hardly had a lot of the things we consider basics today!

Tough as that must have been, that’s what Candido Da Rocha, Nigeria’s first millionaire, had to navigate—and he didn’t just survive; he thrived.

In our Independence Edition, we’re taking you on a journey back in time to explore Candido’s fascinating life. Born into a complex world of slavery, Candido would go on to shape the financial environment that we know as Lagos. Let’s break it down, learn from his journey, and see what principles from that time can still be useful today.

From Slavery to Success: The Da Rocha Family Story

It all started in 1840 when Candido’s father, Esan Da Rocha, was snatched from his homeland, Nigeria, and sold into slavery in Brazil. It’s hard to imagine that kind of hardship. But in a twist of fate, Esan gained his freedom, returned to Lagos in 1871, and built a thriving merchant business. His investments laid the foundation for the Da Rocha family fortune.

Candido himself was born in the Bahia region of Brazil in 1860, and his family eventually returned to Lagos when he was just 7 years old. Growing up in an environment of privilege but also hard-earned wealth, Candido learned early on that fortune could change with a single decision. That awareness was the fuel that drove him to expand his father’s legacy.

Fun Fact: Candido Da Rocha received his formal education at CMS Grammar School, Lagos. Guess who he was schoolmates with? S. H. Pearse, Herbert Macaulay and Isaac Oluwole!

Takeaway: Even in the most challenging situations, laying a solid foundation can set you up for generational wealth. Candido’s journey is proof that sometimes the best opportunities come out of the toughest circumstances. And also that when you do meet favorable circumstances, you may be better off looking to expand them, than resting on your laurels.

Turning Gold into Fortune: Candido’s Shrewd Business Mind

By the time Candido became a young adult, he was ready to take some serious risks. In 1894, he borrowed money from the Bank of West Africa (now First Bank) to buy gold bars from a British prospector. Let’s be real—most of us would probably break out in a cold sweat at the idea of betting our future on one deal. But Candido wasn’t afraid. He took the gold bars, converted them into dust, and flipped the whole lot for a jaw-dropping 200% profit.

That moment didn’t just make him rich; it was the start of an empire. Candido’s calculated risk paid off, and he continued making bold moves, always with one eye on the prize and the other on the potential risks.

Takeaway: So, we’re not asking that you go berserk with risks. Of course, taking risks, especially when the odds are uncertain, can be daunting. But if there’s something we can learn from Candido Da Rocha, it’s that if you know what you’re doing and stay strategic, it can lead to unimaginable wealth.

The Water Business That Hydrated Lagos

While his gold venture made him wealthy, Candido didn’t stop there. He saw another opportunity where no one else was looking—water. In the 1920s, Candido expanded into Lagos’s water supply, a critical resource for the fast-growing city. He did this by laying water pipes that were said to run all the way from Iju to Lagos Island, Yaba Ebute Metta and others; areas known for their high demand of pipe borne water.

He wasn’t just making money; he was solving a problem. Back then, private vendors were hired by colonial administrators to supply essential services like water, and Candido’s operation became the go-to supplier.

Fun Fact or Mindblowing Myth?: Some sources say the Da Rocha family’s wealth was so immense that they sent their laundry to Britain for cleaning. Do you think that’s possible? Or is it just one of those things?

Takeaway: This is a rather straightforward one—find the need, and provide the solution. Whether it’s water or technology, there’s always wealth to be found in addressing essential needs. Candido’s water business was built on the simple truth that when you solve big problems, you can build even bigger rewards.

The Lagos Native Bank: Challenging the Financial Status Quo

In 1907, Candido Da Rocha and two other entrepreneurs, J.H. Doherty and Sedu Williams, co-founded the Lagos Native Bank. At the time, the banking sector was controlled by colonial powers, but these men had a vision—more local ownership and financial independence. This was a bold move, but Candido wasn’t new to breaking barriers. It’s said that their bank competed directly with the Bank of West Africa (First Bank), and most likely the old Barclays (now Union Bank).

Later, he started the Lagos Finance Company, offering loans to Lagosians and cementing his place as a financial pioneer in the region. His banks were a step toward challenging the status quo, offering Lagosians a more accessible path to financial growth, for however long they lasted.

Takeaway: Innovation often comes from challenging what’s already in place. Candido’s work reminds us that creating alternatives, especially in underserved markets, can leave a lasting impact on future generations. So, if you’re having trouble with innovating, maybe the answer will come from identifying gaps in the market.

A Man of Discipline and Generosity

Candido Da Rocha was as disciplined as they come, and his values extended far beyond wealth. According to his granddaughter, Angelica, he had an intense dislike for dishonesty and a strong commitment to his community. During World War II, Candido offered his Bonanza Hotel to the British government to house Nigerian students, ensuring their safety during a tumultuous time.

He had his challenges too—like the falling out with his son, Alexander, who moved to Ghana in the 1920s—but he remained committed to his values; discipline, generosity, and integrity until his death in 1959.

Takeaway: True wealth is built on more than just money. Candido’s legacy reminds us that discipline, integrity, and giving back to your community are just as important as financial success.

It’s A Wrap!

As we look back on the life of Nigeria’s first millionaire, Candido Da Rocha and what was surely an incredible journey, it’s clear that true success can be about more than just wealth, as resilience, foresight, and impact were for Candido. And we’d do well to remember that while the challenges we face today might seem overwhelming, history shows us that adversity often brings opportunity.

So, as you make your own financial decisions this month, remember: success isn’t just about quick wins. It’s about building something that lasts, something that stands the test of time—just like Candido did. Who knows, maybe one day someone will be telling your story too.

Happy New Month!

The SimplVest Team 🚀