Buy land, they’re not making it anymore.

Mark Twain

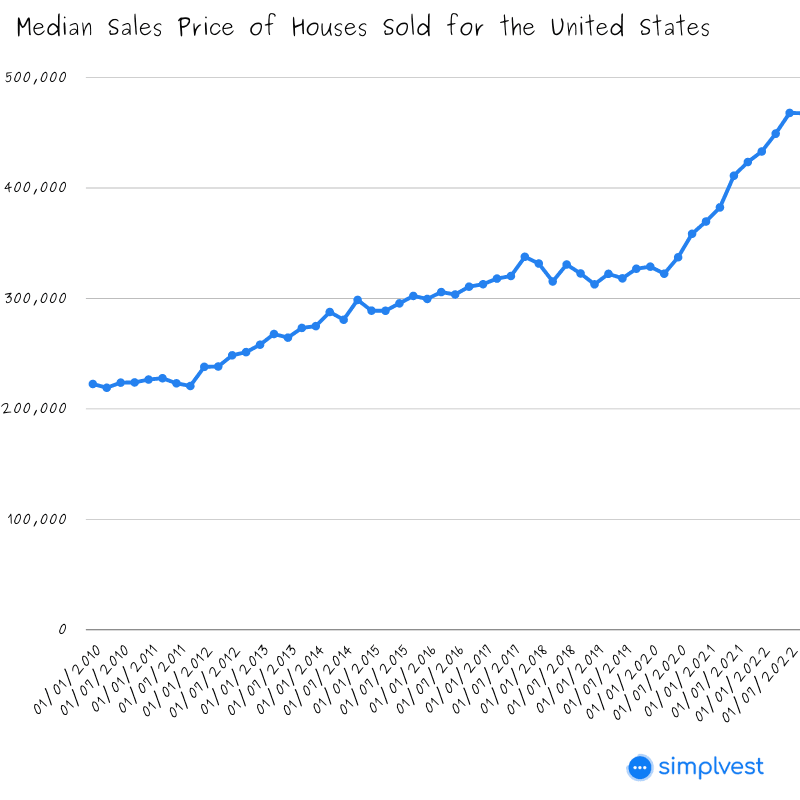

Real estate is popular among investors for being one of the safest and most lucrative investment options. This investment class keeps proving itself, reaching an all-time high in 2022, despite the hit it took during the pandemic.

So, if you want to hop on this train, your low capital shouldn’t deter you. There are many ways to add real estate to your portfolio with as low as $10,000.

Top 4 Ways to Invest $10,000 in Real Estate

1. FHA Loans

Many lenders avoid FHA loans for many reasons, including its stringent appraisal guidelines; however, it is a juicy offer. You should also know that higher interest rates and mortgage insurance premiums (MIP) are required. Yet, it is a relatively fair deal because of its loose requirements.

FHA loans are a type of mortgage insured by the Federal Housing Administration. Depending on your credit score, it may only need a 3.5 percent down payment. This means you can control real estate worth $120,000 with $4,200.

To buy a $250,000 4 unit property we thought we needed a $62,500 down payment

— theficouple (@theficouple) November 24, 2022

Then we learned we could use a 3.5% FHA loan, have a $8,750 down payment & live rent FREE.

Because, real estate 🏡

Shopping for an FHA loan is similar to shopping for a conventional one. First, you will need to

Find an FHA-Approved Lender

Finding an approved lender shouldn’t be too hard. Many lenders, including banks and online lenders, are FHA-approved.

So, ensure you check out several lenders and compare quotes before choosing one. You should watch out for the differences in their rates and fees.

Some of the best lenders include Guild Mortgage, New American Funding, and Bank of America.

Submit an Application

Next, you’ll need to fill out an application form, whether it is online or via email. You’ll be required to provide several pieces of information and verifications, including a credit report and employment verification.

After submission, your application will go through an underwriter. They will review the application to confirm if it aligns with the guidelines for FHA loans. This process typically takes a maximum of 45 days.

Tip: Don’t invest the entire $10,000; you can invest $5,000 or less. Set the rest aside as a reserve for other expenses you may incur. Also, ensure you conduct adequate research so you buy right.

2. Use Real Estate Crowdfunding Platforms

Crowdfunding involves collaborating with other investors to buy real estate properties. You pool your available funds with other investors through a crowdfunding platform and jointly invest in projects.

The best part is that since this option doesn’t require a lot of money, you can invest in multiple projects. So, even if you have $5,000, you can share it to accommodate five projects.

However, you must do due diligence by conducting extensive research before investing. This is because the crowdfunding area isn’t tightly regulated, so exercise the principle of caveat emptor (buyers beware).

Some crowdfunding platforms only offer projects to accredited investors. To gain accreditation, you must meet the Securities and Exchange Commission (SEC) specifications.

There are many real estate crowdfunding platforms. CrowdStreet is a great option, but it only accepts accredited investors. Platforms like Fundrise and RealtyMogul are other excellent choices that do not require accreditation.

3. Rent Out a Space in Your Home

If you have a spare room or rooms, why not invest there? You can invest in revamping, refurnishing, and styling the place so it is every guest’s dream. Doing this will benefit you in more ways than one since you’ll also be increasing the value of your house.

If you don’t know anyone to rent it to, list it on Airbnb. Other remarkable alternatives to Airbnb include Booking.com, Vrbo, and Homestay.

I turned 33 this weekend.

— Lauren | Adulting Is Easy (@AdultingIsEasy) September 21, 2022

I own 8 Airbnbs that generate $20k per month.

Here are 33 things not all Airbnb hosts have (but totally should):

Now, having to rent out your room to strangers can be nerve-racking. You might fear they will invade your privacy and damage or steal property. According to Airbnb, this is rare because of their assessment procedures before confirming every reservation. Airbnb also provides a Host Guarantee of up to $1,000,000 and around the same amount of insurance.

Despite this, it doesn’t hurt to implement some of your security measures. First, you need to start with research. This is important to ensure you follow all the local laws regarding renting your space.

You should also set clear boundaries about what and where the guests can do and go. To reinforce this, you can install security cameras to monitor your apartment even when you’re not there. If you think it’s too much work, you can hire an expert to handle everything from listing to maintenance.

4. Consider Real Estate Investment Trusts (REITs)

A REIT is a company with a commercial real estate portfolio. They allow the public to buy shares and earn income from their real estate without purchasing actual properties.

Price is what you pay. Value is what you get.

Warren Buffet

By law, REITs must pay their shareholders 90 percent of their profits as dividends. It is because by doing so, REITs don’t get to pay corporate taxes on their earnings. So, with REITs, you are promised a steady income pool, but you may witness little to no capital appreciation.

Active income is temporary but passive income is forever. Here are 7 common passive income streams:

— Andrew Lokenauth | TheFinanceNewsletter.com (@FluentInFinance) March 25, 2023

• REITs

• Real Estate

• Renting Space

• Dividend Stocks

• Affiliate Marketing

• Covered Call Options

• Digital Products (Courses/ eBooks)

🧵Let's discuss each:

Investing in REITs allows you to enjoy real estate exposure and diversify your portfolio without incurring all the risks. Property usually under a REIT includes malls, healthcare facilities, data centres, and hotels.

Bottomline

Like Brandon Turner of Biggerpockets and many other successful real estate investors, start. With little, you can build a massive real estate portfolio, and as you have seen, there are several ways to do so.

Some strategies may suit you better depending on your risk tolerance and goal. Do you want a steady income or higher returns, knowing that your returns are proportional to the risks? You need to make that decision.

Once you have decided, start to build. But like the case is with every investment, never invest what you cannot afford to lose.