It’s summertime, and while most people are busy planning how to make the most of a much-needed break, others hope to rip others out of their hard-earned money through scams. Imagine losing all of your savings to a scammer. That’s a level of pain most people can’t recover from.

Here’s what we got for you today on our scam list:

💔 Searching for love in the wrong places

🏠 Charity begins at home, but not like this

🎁 The gift that never gives

🚗 Car problems

💊 Take this pill, lose some weight money

In 5 minutes (or less), you’ll learn about 5 of the most common scams you may encounter this year and how to protect yourself from falling victim to them.

The fight against fraud has gone on since 300 B.C. You heard right; man has had to deal with scams as early as that. It was a peculiar case involving Hegestratos, a sea merchant from Greece. Naturally, he had taken an insurance policy against his ship and its cargo– a practice known then as a bottomry.

With this, you could get a loan because when your ship arrives at its destination, and its cargo is delivered, the loan is paid back with interest. Any default in the loan repayment would mean the ship or cargo is repossessed. It was a pretty standard concept until Hegestratos decided to sink his empty ship, stash its cargo somewhere and keep the loan.

While his plan ultimately backfired, and he drowned while trying to escape the law, scams have plagued us for millennia.

Scams aren’t just dangerous to our finances. They can totally wreck our credit scores and even emotions. The scariest part about them, second to them being very common, is how they keep evolving each year. Scammers are becoming increasingly sophisticated, and staying informed and vigilant’s more important than ever.

❤️🔥 Love Is In The Air…

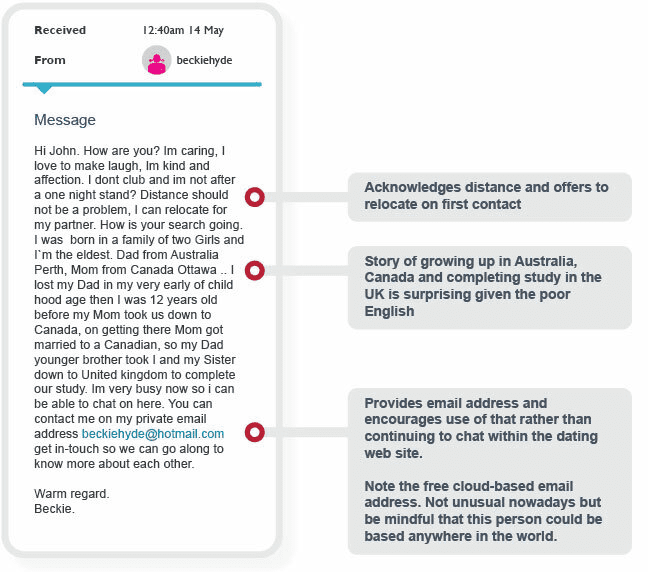

The romance scam is one of those types that could leave your wallet…and heart completely broken. Talk about double trouble.

Netflix did a number on creating awareness on the topic with its special “The Tindler Swindler”, but don’t think these scammers will always be as elaborate as that nightmare. It typically works out as meeting the scammer online through an app or even in person (watch out, summer vacationers). They sweep you off your feet, pretending to care about you.

Then they get you to care about them, which ultimately leads to asking you for financial favours because, frankly, who wouldn’t help someone they loved? It’s a tale as old as time, and no one is safe. If you’re capable of “falling in love”, you could be a victim.

The best defence? Take every [romantic] interaction slowly, enough that you can thoroughly research the person until you’re certain about who you’re dealing with. Remember, “If it is too good to be true…”

😓 Nice Guys Finish Last

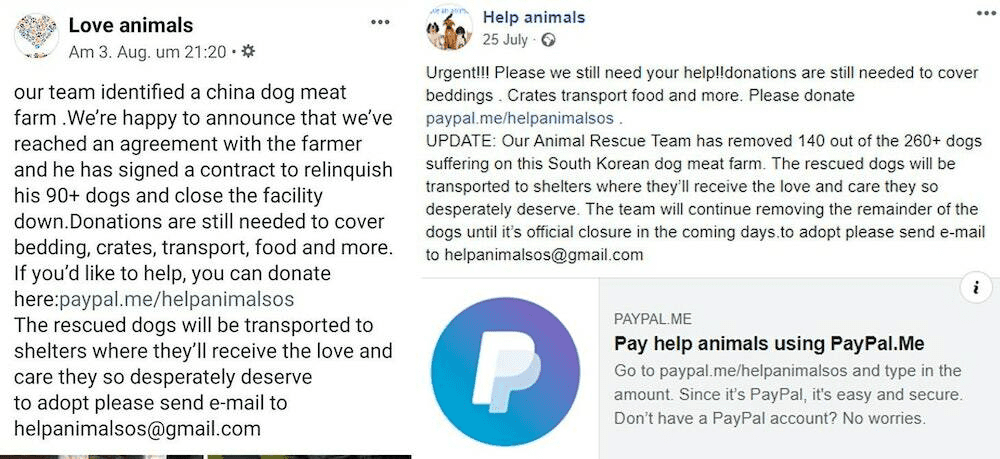

Thanks to the charitable donations scam, your attempt at trying to make the world a better place can leave you in financial ruin.

These charity scammers could be one-man ops or even registered nonprofits, so just because it looks legit doesn’t mean it is. You’d be losing your funds to a fraudster. You’ll likely be directed through an email letter or a website. Sometimes, they go a step further and approach you over the phone or in person. The game is always the same: play on your emotions.

The simple solution is to always research any organization before donating. Sometimes, it’s as simple as looking out for sensationalized descriptions and typos – fake charities on social media are synonymous with these. Always look out for the Employer Identification Number (EIN) if you’re dealing with a nonprofit. If you can’t find it, that’s your sign to bounce.

🚗 Cars 1, 2, 3…

If you live in the U.S., getting calls about extending your ‘expired’ car warranty is probably a part of your daily routine.

It’s even spawned a series of memes.

If you’re already ignoring the heck out of these calls, keep it up. Unlucky victims have been prompted to provide personal or financial information or paid fake extended car warranties. It’s a sad way to lose out on thousands of dollars.

🏋🏽 Shed Some Pounds…. And Cash too!

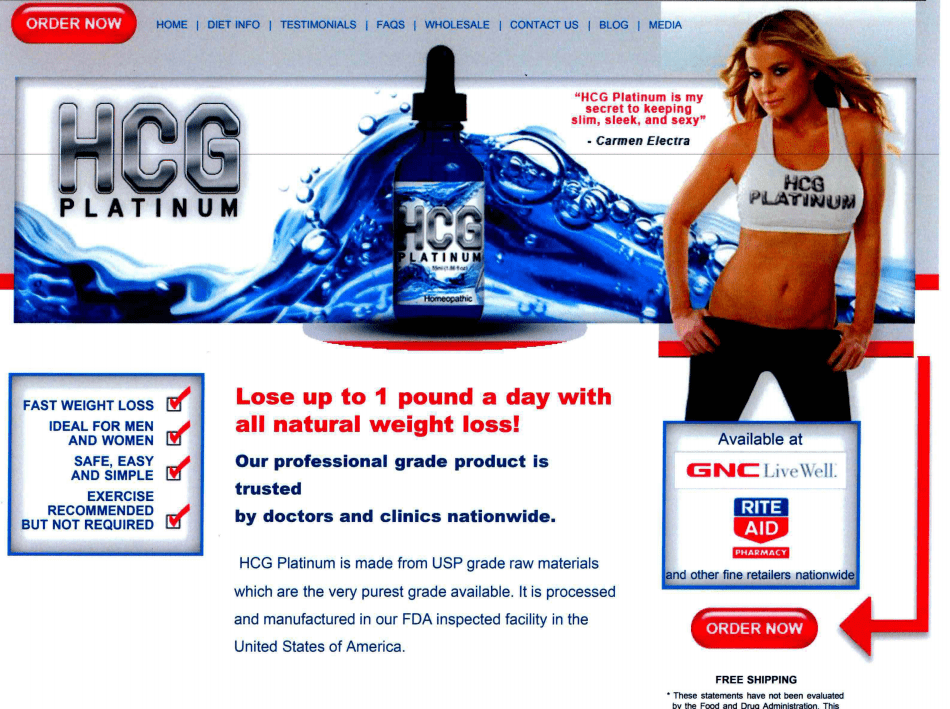

The unfortunate thing about fitness and weight loss scams is that they prey on a very human desire to achieve that perfect ‘bod’. And with summer well underway, many people will fall victim to this trojan horse of a promise. In a bid to shed a few pounds, you could be making your accounts lighter.

These scams typically involve some fake website promoting a fitness program. The end game? You provide your personal or financial information, they clean you out. Sometimes, it even looks harmless, with the scammer getting you to sign up for a fitness product or cheap gym membership. It’s all the same– these ‘programs’ are gunning for your sensitive information.

Again, we say: “if it seems too good to be true…”

🎁 Gift Card Scams

We all love gifts. They make you feel special. This class of scams prey on that whole concept, often with dire consequences. AARP’s 2022 survey revealed that about 26% of U.S. consumers received a gift card with absolutely no funds. What’s the big idea?

These gift card hustlers will often advertise a gift card exchange service that helps you “check” the gift card balance. With a simple prompt, you input your card info; voila, they drain it completely. It’s a pretty sinister way to ruin something otherwise useful.

As a precaution, ensure you only buy or exchange from reputable resellers, and take a closer look to ensure your cards haven’t been tampered with— another form of gift card scam involves taking the cards off store racks, tampering with protective strips, and stealing the bar codes.

⚔️ How To Protect Yourself From Scams 🛡️

- Try not to use a debit card – they’re linked directly to your checking or savings account and don’t offer the same consumer protections credit cards do.

- Only click trusted links– treat every link with suspicion

- Don’t answer calls from unrecognized numbers

- Never let your credit card out of your sight – a skimming device can easily read your card’s magnetic strip and store the card’s information. If you can, minimize how often someone swipes it out of your sight.

- Monitor your credit like a hawk – this helps you detect any fraudulent activity, especially with new accounts you didn’t authorize. Keep an eye on your credit with a free credit report from Annual Credit Report.

You’re right to feel that your finances are at constant risk. Luckily, just by being vigilant and cautious– you’re protected from most scams.

Remember never to rush into any financial decisions, and always listen to your gut.

With financial scams, prevention is always better than any cure.