Source- Pexels

Do you often question financial freedom and security but don’t know where to start? Dave Ramsey opined on the solution to this in his bestselling finance book “The Total Money Makeover.”

“Personal finance is 80% behavior and only 20% head knowledge. It’s not what you know that makes the difference; it’s what you do.”

As such, there are three building blocks you may master when it comes to architect your financial success: budgeting, saving, and investing.

Dave Ramsey

Mastering these concepts can be a game-changer for your financial future. For instance, a solid understanding of budgeting allows you to take control of your spending while optimising your savings ensures that you have a cushion for unexpected expenses or emergencies. Likewise, investing can help grow your wealth over time and potentially turn your financial dreams into reality.

With that said, let’s dive into how these three work and see how they put you on the path toward financial freedom.

BUDGETING

The concept of budgeting includes being your financial superhero with a secret weapon called “planning.” Budgeting is crucial to financial success because it helps you save the day by managing your money effectively and achieving your financial goals.

Suze Orman, a well-known finance influencer on budgeting and savings, remarked that

“Budgeting is not just a restriction; it’s a freedom. When you budget, you ensure that you use your money the way that matters most to you.”

However, the truth is that sometimes budgeting can seem daunting. Still, by following some strategies, you can turn budgeting into an easy and rewarding activity that helps you take control of your money.

First, start by tracking your expenses. It can be as simple as writing down every purchase you make for a few weeks or using budgeting software to track your spending automatically. Doing this can help you quickly identify areas where you can cut back and save more.

Next, set financial goals. These can be short-term, like saving for a vacation, or long-term, like paying off your mortgage or saving for retirement.

2022 Financial Goals

— Money Africa (@themoneyafrica) January 4, 2022

1. Write it down

2. Draw up a budget

3. Build an emergency fund

4. Invest in a mutual fund

5. Build stock portfolio

6. Start a side hustle

7. Read personal finance book

8. Invest in personal development

9. Reinvest your returns

10. Join a finance community

It would help to write down your goals and make them specific and measurable. This will give you something to work towards and help you stay motivated.

Next, you will need to prioritize your spending after you clarify where your money is going and your goals. This part involves focusing on the most important things to you and cutting back on those that aren’t. For example, if your goal is to save for a down payment on a house, you might need to cut back on eating out or buying new clothes

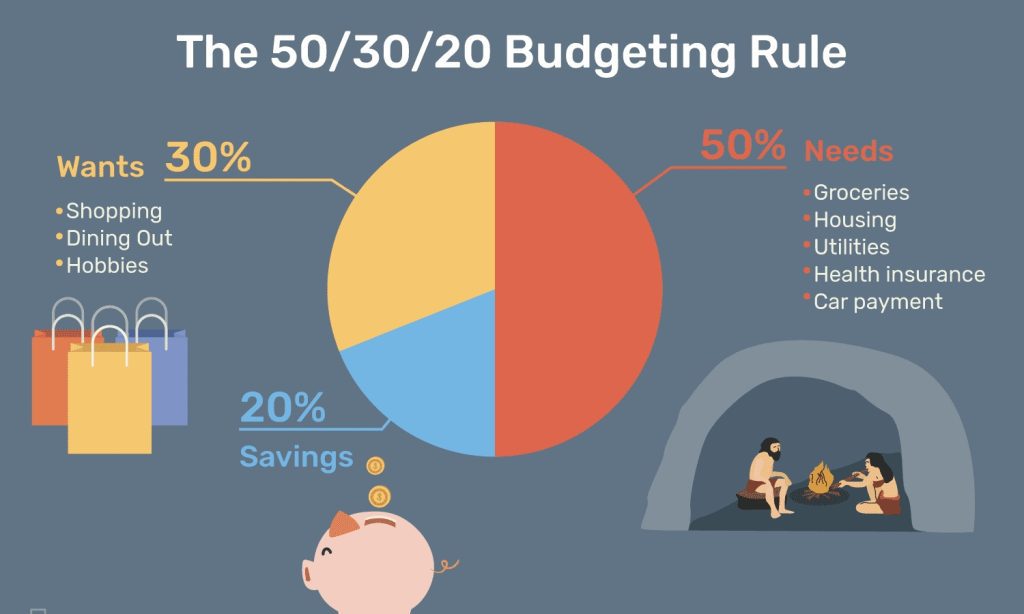

50-30-20 RULE

An excellent method to adopt for prioritizing income spending is the 50-30-20 budgeting rule.

According to the guideline, you should divide your after-tax income into these three major groups:

50% for your needs – included in this category are costs necessary for your living standard. They may include rent or mortgage, utilities, groceries, transportation, and other expenditures.

30% for your wants – It can contain luxuries you love spending money on, such as entertainment, dining out, hobbies, travel, and other extras.

20% for savings and debt repayment – In this category are donations to your emergency fund, retirement account, and savings accounts, and paying off any outstanding debts, including credit card, student loan, and auto loan balances.

Regardless of the options you select, there are budgeting platforms you may use. These platforms would aid in curating an excellent budget based on your income. Some of them include:

Mint: Mint is a free budgeting platform that provides personalized insights and advice to help you make better financial decisions.

YNAB: You Need a Budget (YNAB) is a budgeting platform that enables you to create a budget based on your income and expenses.

Personal Capital: Personal Capital is a platform that offers both budgeting and investment tracking.

SAVINGS

Savings – the dreaded evergreen topic of personal finance. But fear not, as building towards it is rewarding and achievable. Here are essential tips to know about saving money.

Firstly, saving money is all about mindset. It’s necessary to shift your perspective from thinking of saving as a chore to viewing it as a form of self-care. You are investing in yourself and your well-being by caring for your financial future.

One of the best ways to save money is to automate your savings.

Set up an automatic transfer from your checking account to your savings account every month. This way, you won’t even have to think about it and you will be surprised how quickly your savings will add up.

Another tip is to be mindful of your spending. Keep track of your expenses and identify areas where you can cut back. For example, do you need that daily latte from the coffee shop, or can you make your own at home? Small changes can add up to significant savings over time.

Comment

byu/miktrick1000 from discussion

inAskReddit

There are various ways you may save money. You may use a traditional account or some other like Qapital or Chime.

INVESTING

Investing involves buying assets with the potential to increase in value over time, with the expectation of earning a return on your investment.

Four ways to make money:

— Steve Burns (@SJosephBurns) September 19, 2020

Build a career.

Build a business.

Build an investment portfolio.

Build a trading system.

Several types of investments include stocks, bonds, mutual funds, ETFs, real estate, and alternative investments like art or cryptocurrencies.

For beginners, the first step is to open a brokerage account with a reputable brokerage firm. There are numerous online brokerage services at your disposal. Robinhood, Charles Schwab, Fidelity, Vanguard, and are examples of brokerage sites that require zero commission.

To manage investment risk, it’s essential to diversify your portfolio by investing in various assets. Additionally, monitoring your investments regularly is important to ensure they are performing as expected and to make any necessary adjustments.

Remember that investing is a long-term game, and patience is vital. Don’t be discouraged by short-term market fluctuations; stick to your investment plan. With a solid strategy and diversification, you can reach your financial goals.

BOTTOM LINE

By mastering the basics of budgeting, saving, and investing, you can take control of your finances and build a secure financial future.