Don’t let freelance scams catch you off guard. Learn the 10 telltale signs of scam clients and how to protect yourself from shady schemes in freelancing.

Let’s talk about something that’s unfortunately too common in the gig market— freelance scams. In the quest for that extra income from our side hustles, it’s easy to get caught up in the excitement of new opportunities, but scammers are often looking to prey on freelancers who might not know the warning signs.

Picture this: you’re scrolling through a job board when you spot the perfect freelance gig. It’s exactly in your niche; the pay looks solid, and the client seems friendly. Excited, you reach out and—bingo! They reply almost instantly. They love your work, they’re eager to get started, and there’s just one small thing… they need you to complete a “quick” unpaid test project. Sound familiar?

For many freelancers, it’s an all-too-common scenario. To help you steer clear of these pitfalls, this guide will walk you through the top red flags/ top signs of freelance scams and how you can protect yourself. With a bit of caution and know-how, you can keep your freelance journey safe and focused on what matters—finding great clients and delivering amazing work.

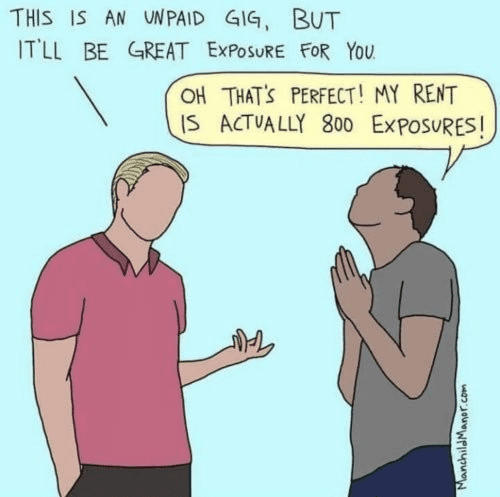

1. The “Asking for Free Work” Scam

Many scammers try to get free work by requesting “test projects.” They may even argue that doing a free test is standard practice, but this isn’t entirely true. A legitimate business may ask for a small, paid trial project or refer to your portfolio, but unpaid tests can be a major red flag. If a client insists on free work, consider the true intention—it might just be free labor!

Tip: Suggest showcasing relevant pieces from your portfolio or offer to complete a small, paid assignment. Most serious clients will respect this approach as they understand your time is valuable.

2. No Contract in Sight

Contracts protect both you and the client by outlining the work, deadlines, and payment terms. A professional client will either send over their contract or be open to signing yours. Be wary of anyone avoiding this step, as it often means they don’t intend to hold up their end of the deal.

There will always be that client who wants to “skip the paperwork to speed things up.” This should signal caution, so don’t fall for it. Insisting on a contract keeps both sides accountable and professional.

And when you do get the contract, take your time to go through it. Don’t be in a hurry!

3. Suspicious Contact Details

Receiving emails from addresses like “[YourDreamClient][email protected]”? Legitimate companies use official domains that match their business names, like “[email protected].” Email inconsistencies are a red flag, especially if the message comes from a generic or free email provider.

Pro Tip: Before engaging, verify their website and online presence. A Google search can quickly reveal if their details don’t add up.

4. “Exposure” as Payment

We’ve all heard this one: “We can’t pay you, but you’ll get great exposure!” The infamous “exposure” offer is a scam that’s way too common. Exposure won’t pay the bills, and neither will payments in odd formats like gift cards or “favors.” Your work deserves real monetary compensation, so don’t settle for anything less.

Occasionally, you’ll have to entertain Requests for Unconventional Payment. Like we said before, they don’t pay the bills, so ignore them. Moreover, payment in gift cards or “credits” instead of cash is a scammer’s tactic. Always insist on actual currency through secure, reliable channels like third-party international payment apps (like Geegpay), your dom account (for international gigs) or direct bank transfer.

5. “You Need to Pay to Get Started”

Never pay a client to access work or buy any specific tools they claim are “necessary” for the job. If a company is asking for money upfront, it’s likely a scam. Reputable businesses either provide the necessary tools themselves or allow you to use your own.

Warning Sign: “You’ll need to make a $50 deposit to secure this role.” Walk away. There’s no need to pay to get paid.

6. Pressuring You to Make Quick Decisions

Scammers often create a false sense of urgency, pressuring you to decide immediately. Legitimate clients usually give you time to think things over. If someone’s rushing you to sign on, it’s worth slowing down and evaluating the offer.

“You have 24 hours to respond, or we’ll move on to the next candidate.” Any client making threats to push a contract isn’t one you need. Your peace of mind matters above all, anyway.

7. Overly Vague Job Descriptions

Scammers are often intentionally vague. Real clients know what they need and will give you a clear project outline. If they can’t provide specifics or continuously dodge direct questions, it’s best to pass.

Warning Sign: If they avoid your questions about the scope of work, likely they don’t know themselves or are hoping you’ll work without clarifying your tasks.

8. Rushed or Pressure-Filled Approach

If the client pushes you to accept quickly or pressures you to skip your usual due diligence, they’re likely trying to trap you before you can realize it’s a scam. Real opportunities don’t require immediate responses.

9. Sketchy Website or No Social Media Presence

In 2024, even the smallest businesses typically have a website or social media profile. If the client lacks any online presence, or their social media pages look unusually bare or inactive, take a step back and evaluate the legitimacy of the offer.

Tip: A basic Google search can reveal a lot about the company. No presence, or multiple shady websites? You’re better off passing.

10. Requesting Personal Information Too Soon

Some information, like tax IDs, is necessary after you’re hired. But until then, Protect your identity! No legitimate client will need your home address or card details before onboarding. Even payment information should wait until after an official hiring. Keep personal data secure and only share it when necessary. (Else you might fall victim to an imposter scam)

Tip: For U.S.-based freelancers, consider using an Employer Identification Number (EIN) instead of your Social Security Number (SSN) to safeguard your private information. For Nigerian freelancers, the NIN doesn’t carry the same implications as the SSN, but you should still keep it, your BVN and other information secure.

How to Protect Yourself from Freelance Scams

- 1. Get an EIN: If you’re in the U.S., applying for an Employer Identification Number (EIN) allows you to avoid sharing your Social Security Number.

- 2. Do Your Research: A quick Google search on the company name can help. Look at their online reviews, website, and social media presence to confirm legitimacy.

- 3. Talk to Other Freelancers: The freelance community is an excellent resource! Ask if anyone’s worked with this client or if they’ve had similar experiences.

- 4. Trust Your Gut: If something doesn’t feel right, it’s okay to walk away. There are plenty of reputable clients out there.

The Bottomline

Freelancing is an exciting journey, but staying cautious and watching out for these common freelance scams is essential. Sure, it can feel like running an obstacle course, and unfortunately, scams are part of the terrain. But with a little vigilance and some helpful strategies, you can easily sidestep these traps.

Remember, a good client respects your work and compensates you fairly, and plenty of genuine clients will value/ respect your work. Keep these tips handy, stay alert, and you’ll be better equipped to navigate the freelance market securely. Happy freelancing, and stay safe out there!