According to a Personal Capital study in 2021, the average age of a new investor is 33. In the same light, a Gallup poll showed that only 26% of people invest in any asset before the age of 25. Since the key to investing is starting early, these aren’t exactly excellent numbers.

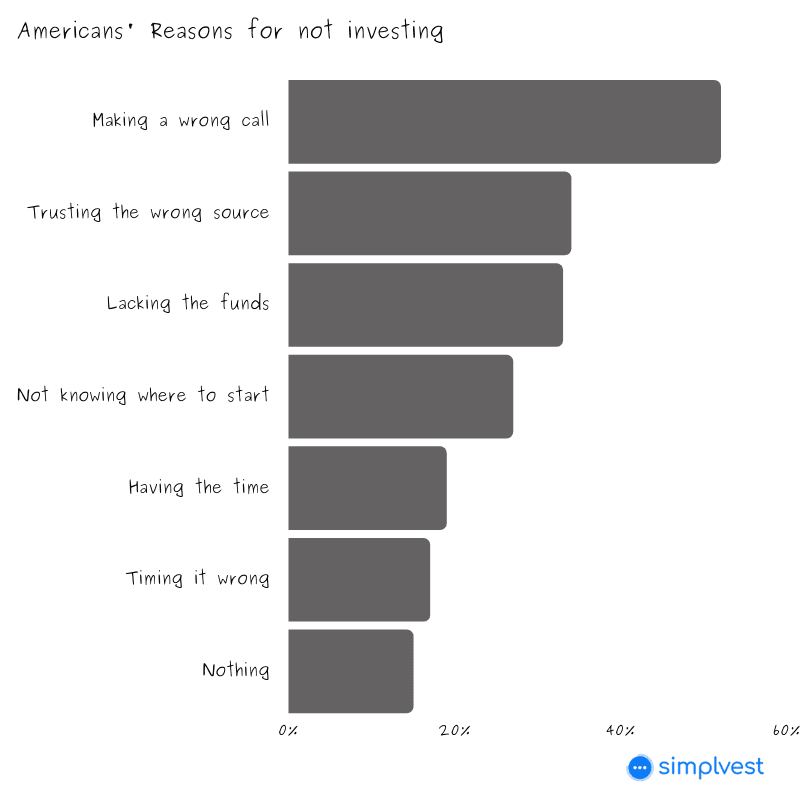

Thanks to its complex nature, investment can be a testy subject for most people. This is probably why many people approach investing with a side eye, and some never get to it. There are many other reasons, as Ally Invest’s ‘Someday Scaries” Survey shows:

[optin-monster-inline slug=”hedb5j7q86brhvjqmd8s”]

But you have nothing to fear if you’ve got the right resources to guide you. This article will cover the top investment tips for beginners to start strong with. Let’s begin.

Top 5 Investment Tips for Beginners

You may already know the basics:

- Scan The Playing Field And Gather Enough Information,

- Only Invest What You Can Afford To Lose,

- Invest Regularly/ Consistently: Every Month And Every Year,

- And, Of Course, Diversify Your Portfolio (Aka Mix Things Up).

But you can find this information anywhere, seven days a week through Sunday. So let’s focus on the secrets most people won’t tell you.

1. Investment accounts are the way to go

You know how they say, “without a solid foundation, you’ll struggle to make something of value”?

Investing is one of the best examples; an investment account is a solid foundation for this journey.

If you’re investing for retirement, your go-to investment account would be either a 401(k) or an individual retirement account (IRA). 401(k)s apply when you are an employee. But, if you are self-employed the IRA (either traditional or Roth) is perfect.

Retirement accounts can have rules about when you can take out your money, so if you’re saving for something else, it’s usually better to avoid them. Instead, a taxable brokerage account will do the trick, and you can withdraw without worrying about taxes or penalties.

The basic concept behind these investment accounts is this: they provide a place for you to hold cash and your investments. Think of it like a bank account but for investment purposes.

2. Say ‘No’ to stocks/ shares and ‘Yes’ to index investing.

Sure, investing involves many risks, but that doesn’t mean you should go in head-on. The truth is that directly investing in shares is very risky, and for a beginner, that’s not the wisest way to start. Index investing, on the other hand, is a much smarter step.

Index Investing is a wealth hack.

— The Market Hustle (@themarkethustle) February 16, 2023

Consistently investing into a fund (such as an S&P 500 Index Fund) is one of the easiest and simplest ways to turn your active income into forever income.

The best part about it? You don’t have to do anything except invest and stay patient.

An index is like a big basket filled with many different things that reflect how well a specific part of the stock market is performing. By investing in an index fund, you’re acquiring a small piece of every company in that basket. This helps you have a more diverse range of investments in your portfolio, which is smarter than only owning a few individual stocks.

An index fund is a type of investment that aims to track the performance of the same assets in an index. It’s less risky and has a good track record. For instance, the S&P 500, a way to measure how well the 500 largest American companies are doing, has returned over 10% annually.

$100,000 in a bank account earns less than $100 per year,

— Andrew Lokenauth | TheFinanceNewsletter.com (@FluentInFinance) March 19, 2022

$100,000 invested in an S&P 500 index fund can earn over $10,000 per year.

You cannot save your way to wealth, you must invest.

The wealthy understand this.

Additionally, you don’t need to manage your stocks actively with Index investing. This passive investing can be great for those afraid of not having the time they think it takes to invest.

N.B: It is important to remember that future returns are not guaranteed

3. Don’t be afraid to miss out.

Remember the Ally Invest stat on 17% of respondents being afraid they had already missed out on making profits? It’s a huge reason why many people shy away from investing, but it’s also a reason why some that do aren’t successful. All of these can be summarized into a social term called FOMO.

FOMO means Fear of Missing Out and describes the fear that others have access to more life-changing opportunities than you do. It can lead people to make weird decisions, such as putting all their money in a high-risk investment, just because they don’t want to be left out if it pays off and brings in huge returns.

You need to ditch emotions when investing. It’s important to stick to your investment plan and not let fear or greed cause you to make quick decisions when the market goes up or down.

As Warren Buffet puts it, “Be scared when others are greedy and greedy when others are fearful.” During times when investments are doing well, it’s a good idea to rebalance your portfolio. You can do this by:

- Selling some of your high-performing assets

- Investing in things like international and value stocks may be slower.

4. Embrace the Power Law

Every new investor needs to understand that investing involves statistics and probability. And a given rule is that extreme scenarios (also called outliers) tend to happen less in a normal distribution of outcomes. In investing, the Pareto principle shows that 80% of the results you get are from 20% of actions.

An easier way to explain this is to say that the top 20% of your investments will likely represent 80% of your returns. This means you can control how well your investments do by focusing on the ones that are doing the best.

Aligns with the Pareto Principle ~11.83% of total investments resulted in 85% of the total returns.

— Mayank Mehraa, CFA, MBA, FRM (@CravingAlpha) September 12, 2022

Day traders quite won’t get this!

This principle is effective if you’re looking to be a passive-active investor. You won’t be rebalancing your portfolio regularly. In shorter terms, you buy, you hold, and you wait. It may sound weird, but you just need to:

- Research a host of assets that are quality and have the potential to perform well

- Add the selection to your portfolio

- Leave them alone for an extended period

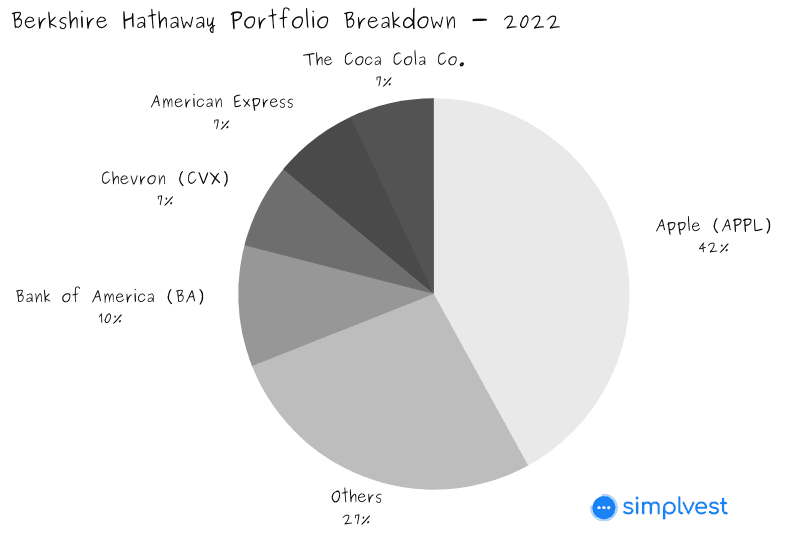

An advantage to this strategy is that your selection will be well-researched and thought over. And it works too! For instance, Warren Buffet has effectively followed this principle, with his five largest holdings being 73% of his equity portfolio at Berkshire Hathaway in August 2022:

Of course, you’re welcome to examine if this strategy is for you, seeing as it goes against what modern corporate finance teaches on regularly re-examining and rebalancing portfolios.

5. Consider the constant dollar plan

When you invest the same amount of money no matter what happens in the stock market, you are practising the constant dollar plan (Or dollar cost averaging). By doing this, you can enjoy market swings and cut the negative effects on your mix of stocks, bonds, etc.

Additionally, you get to

- Purchase More Stocks At Lower Prices And Fewer Stocks At Higher Prices

- Foster The Habit Of Consistently Investing To Accumulate Money Over Time,

- Take Emotion Out Of Investing And Keep You From Potentially Lowering The Rewards On Your Account.

Your investment horizon, market outlook, and prior investing experience determine the frequency with which you use it. You could try it if you believe the market is in flux and will eventually rise.

Final Thoughts on Investments for Beginners

In summary:

- Investment accounts are the way to go

- Say ‘No’ to stocks/ shares and ‘Yes’ to index investing.

- Don’t be afraid to miss out.

- Embrace the Power Law

- Consider dollar-cost averaging.

By following our tips, you can position yourself for success and achieve your financial goals. With the right mindset and approach, anyone can become a successful investor.