When the former Twitter CEO listed the first-ever tweet on the social media platform as an NFT valued at $2.5m, the internet went agog! Explaining his decision, he said:

“Owning any digital content can be a financial investment, It can hold sentimental value. Like an autograph on a baseball card, the NFT itself is the creator’s autograph on the content, making it scarce, unique, and valuable.”

— Jack Dorsey, Twitter founder

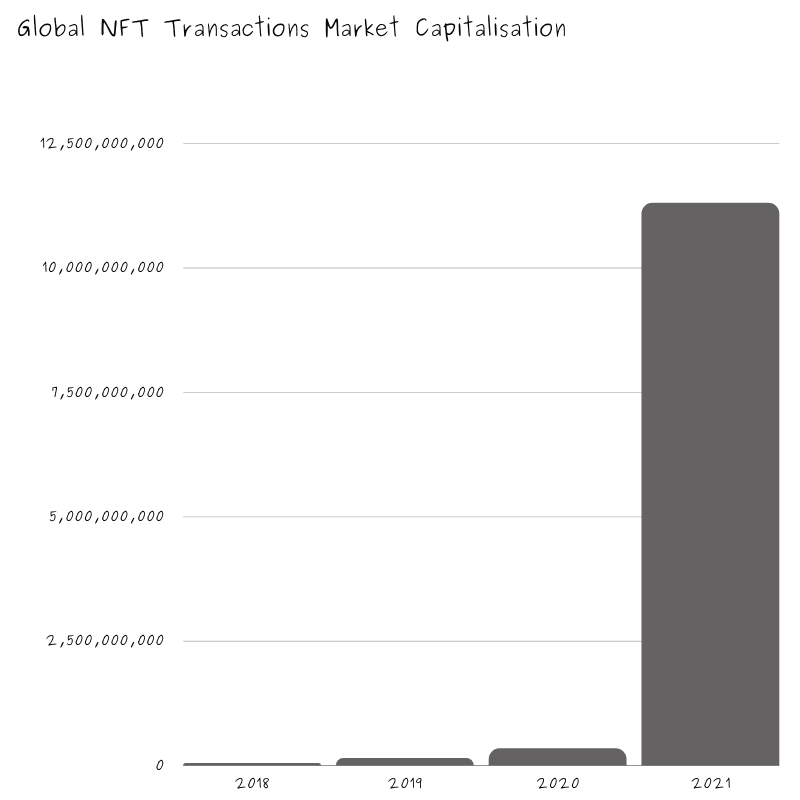

The year 2020 is known for many things including the global pandemic, the bitcoin surge and financial shocks. In the same year, investment circles and Wall Street brokers were shocked when the NFTs market grew by 229%. You must be wondering what NFTs are and why it is making such a rave!

It’s your lucky day because this article demystifies what NFTs are and how you can invest in them. We add a cherry to this cake by telling you why major financial players value some at high prices and would not touch others with a ten-foot pole. Jump right in to learn more!

just setting up my twttr

— jack (@jack) March 21, 2006

The Digital Buzzword to look out for

NFTs are an acronym for Non-Fungible Tokens and they are digital blockchain-linked tokens that cannot be interchanged with any other asset because of their unique properties. This means they cannot be replicable but exit to bridge the gap between physical and virtual economies. e.g, an original painting, house, Television set, phone etc.

Fungible tokens are easily interchangeable across time and space. E.g, a dollar bill can be exchanged with another currency like Pounds or Euros. The value remains the same and it can be re-exchanged back to the Dollar.

The painting of the Mona Lisa is worth millions, precisely because it is original and can not be duplicated. While it can be turned into multiple digital files, the original artwork is not replicable nor interchangeable and remains extremely valuable.

The tokenisation of physical items is still underway, however, digital content has taken the front row. Content creators can now publish their work without sharing their earnings with platforms and even earn royalties. NFTs, bake ownership rights into the content itself.

NFTs are unique assets in the digital world that can be bought and sold like any other piece of property, but with no tangible form of their own. Digital tokens can be thought of as certificates of ownership for virtual or physical assets.

Like many other digital investments, there are sceptics who believe that there is a likely burst of the NFTs bubble which may lead to a loss in investment. In spite of this, the growing popularity of NFTs looks like it is here to stay. You can read about the best cities to live in the US as a multicultural young working professional here.

Investing in NFTs and how they work

Artworks and paintings can be turned into tokens to create a digital certificate of ownership that can be traded. These tokens have unique metadata that cannot be replicated. NFTs are created through smart contracts that assign ownership and transferability.

The process of creating an NFT is called a minting process which includes creating a new bloc, validating information and recording information into the blockchain.

Each token has a veritable owner. For instance, when you purchase an NFT, the ownership of the unique token is transferred to your wallet. This token proves that you own the original copy of the digital file and this can be verified via private and public keys.

If you are a content creator, then you are in double luck! When you create an NFT, you can easily prove you are the creator. Just like free markets, you determine the scarcity or supply of your asset. Probably the best part, you can earn royalties every time your NFT is sold.

You might be wondering what happens when people screen grab your work and claim ownership online. The more your token is screen-grabbed and shared, the more popular it becomes and the value increases while you maintain the verifiable ownership.

Where you can buy NFTs?

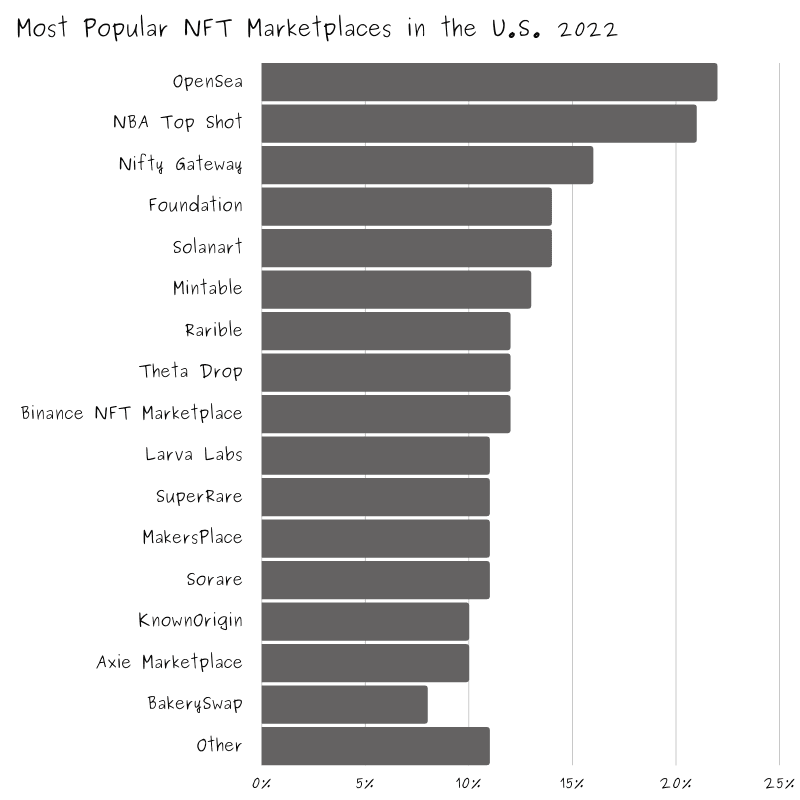

NFTs can be sold on digital platforms on a peer-to-peer basis, this means you are not locked into any platform nor require an intermediary. You can also purchase NFTs on websites like OpenSea, Mintable, and Nifty Gateway. Keep in mind that many NFTs need a special type of cryptocurrency called ether (ETH) which you can store in a cryptocurrency wallet.

Some NFTs are worth more than others, here’s why

All artworks don’t sell the same way, why? Because they are valued differently. The value and interest earned on an NFTs are fuelled by headlines and speculations of multi-million dollar sales. More like how speculation affects stock prices, NFTs are affected by headlines. This suggests a bubble that critics often warn about.

Quite frankly, there are speculations that there would be losers in the NFTs bubble, however, we must equally agree that many digital artists are making bank. The key is deciding your risk appetite and how much you are willing to go.

Now you know what NFTs are and why you should care, go forth and make bank!