For expats living in Europe or North America, building wealth is likely a top priority. Luckily, there are many ways to make your money work harder. Examples include diversifying your investment portfolio to leveraging tax-advantaged accounts.

This article examines some of the most effective investment strategies for high-earning expats. It will also provide valuable insights to help you make sound financial decisions.

Overview of the investment options available for expats

Moving abroad to work comes with many challenges. These include adjusting to a new culture, housing or even tax regulations. But an often overlooked challenge is knowing how to manage your investments. And it’s not as simple as having a broker. One common problem U.S. expats recently faced is having their accounts shut down. There is also the issue of overseas brokers being wary of working with expats.

Yet, the situation is far from irredeemable. Expats can still find investment options and strategies that work in their favour. For instance, the smartest move is to invest in a portfolio of various investment options. A financial adviser or wealth manager can manage this.

As always, while we provide information to simplify the process, it is only intended as a guide. Your circumstances will influence which investment options are best for you.

Investment Options for Expats in Germany and related spaces

Invest through a broker

Finding a broker saves you the hassle of figuring out the investment process. Most U.S. and U.K. brokers don’t provide services to expats outside of the countries where they operate from. So, the obvious solution is to find a broker where you now live/work. It is less risky, and you get the same security you would have if it were a broker from back home.

Some popular names offer services to foreigners if you’re investing through a broker as an expat. Here are a few examples:

- Interactive Brokers: Offers investment options in stocks, bonds, options, futures, and forex. They have offices in many locations worldwide, including Germany. IB offers multi-currency accounts to make managing your investments in various currencies easier.

- Deutsche Bank: This is one of Germany’s largest banks. They provide investment services to German residents and expats. They provide a variety of investment products, including managed portfolios and ETFs.

- Comdirect: This German-based online broker provides various investment products, including bonds. They have an easy-to-use platform and low fees, which makes them a popular choice in Germany.

Passively Manage Individual Stocks as Indexes

A great option is to manage individual stocks as index funds passively. Passive investing is a long-term wealth-building technique. It involves purchasing and keeping securities that resemble stock market indexes.

It can reduce risk because it helps you invest in various asset types rather than a single company.

Index Funds vs. Individual Stocks

— Brian Feroldi (@BrianFeroldi) April 11, 2021

Concentrated vs. Diversified

Value vs. Growth

Micro-cap vs. Large-cap

There's no "right" way to invest

There's just the "right" way for you

We know that diving into the active management of individual stocks as a strategy would be difficult and less effective. But the idea here is to combine both elements. You create a portfolio of individual stocks with good potential but treat them like an index fund and passively manage them. Why? Individual stock portfolios may offer some advantages on cost and taxes. On taxes, individual stocks provide more opportunities for tax-loss harvesting than index funds. This comes with a potential benefit of up to 0.5 %/year, depending on the tax bracket.

An investor with individual stocks can gain extra tax management benefits. This can be through donations, gifting and dividend yield management. In contrast, locally-domiciled index funds have a host of issues, such as:

- Not being available,

- Facing unfavourable or double taxation in the country of residence, and

- Having high expense ratios.

With this in mind, an individual stock portfolio may be the best way to cover the local stock market.

On cost, individual stocks are preferable to index funds due to zero expense ratios*. This can be higher than the more inclusive S&P 500 index, a significant factor to consider.

NB: An expense ratio is the cost of owning a fund over a year, which can impact returns. It represents management, marketing, advertising, and other costs associated with running the fund.

Invest In Private Pension Plans

European countries, like Germany, require employed residents to contribute to public retirement insurance. It is automatically deducted from your pay stub. It also entitles you to a pension upon retirement. This is approximately 70% of your working net income.

The problem with this is that these public pension plan regulations are unpredictable. For example, the monthly pension contributions could reduce. Or the retirement age could increase. This isn’t the best option to bank on as an expat, especially if you can’t put a clock to your time abroad.

The solution? Consider investing in private pension plans. They can add to your contributions to the public pension plan. The benefit is that you get a much softer landing for retirement. There are two German private pension plans you could invest in:

- Riester-Rente: also known as Förder-Rente. This private pension offers a government bonus of 175 Euros yearly. If you’re under 25, you get a one-time bonus of 200 Euros. To get the largest government bonus, you must invest at least 4% of your annual income (a maximum of 2,100 Euros per year). This amount includes both the government bonus and the premiums you pay). Tax benefits include claiming tax on premiums paid into the pension plan. If you join this pension after 2011, you could receive your money starting at 62.

- Rürup-Rente: also called the Basis-Rente, is a private pension plan in Germany. It offers tax benefits such as a guaranteed life-long pension. There is also protection from legal claims. This plan also has a maximum tax-deductible amount of 24,100 Euros per year. It is suitable for those with high income who stay in Germany long-term.

Investment Options for Expats in the US and related spaces

Open U.S.-Based Investment Accounts

The U.S. stock market is a prime platform for some of the best investment opportunities in the world. Certain financial institutions offer investment accounts to U.S. expats living abroad. This service often extends to expats living in North America.

Opening these accounts gives you various investment options like mutual funds and bonds. While brokerages that offer these services reduce due to regulations, noteworthy mentions include:

- TD Ameritrade

- Charles Schwab International

- Interactive Brokers

- JPMorgan Chase

- Zacks Trade

Invest in Real Estate

Generally, investing in real estate can help build wealth and generate passive income. This makes it an excellent long-term investment.

I have lived through two major financial crashes – the early 1990s in the former Soviet Union and 2008 here in the United States. Money can turn into nothing very, very quickly. My advice would be: Invest in real estate. It's the only thing that doesn't depreciate. https://t.co/rk1t4m3DyF

— CaliNurse (@Sibir123yachka) March 16, 2023

Yet, investing in real estate in the U.S. isn’t without its challenges, such as:

- Financing the buying due to lenders’ reluctance to offer mortgages to foreigners,

- Some property types not being suitable for foreign buyers, and

- The potential tax implications if they’re a foreign property owner in the US.

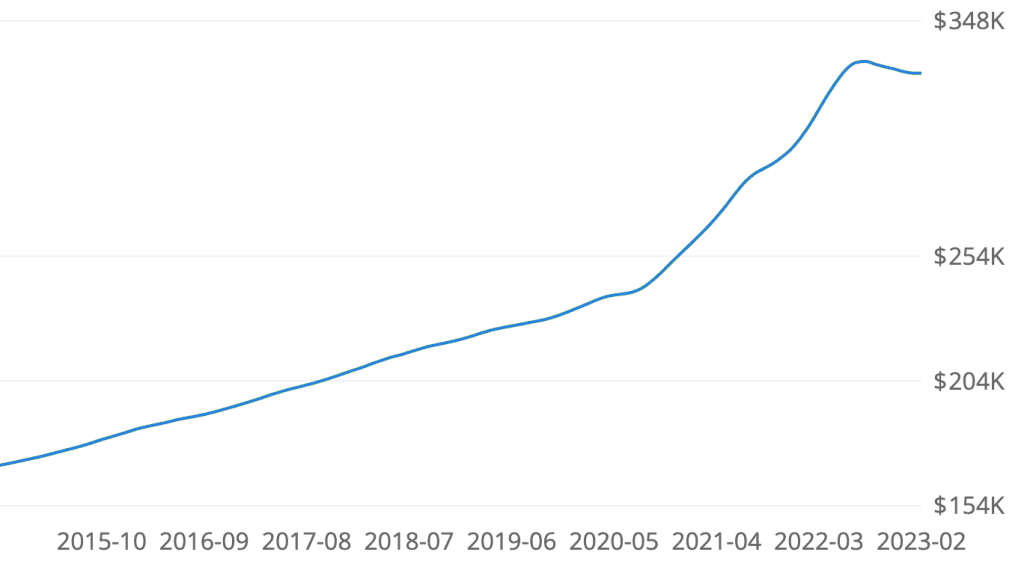

The only major issue with buying real estate as an expat is financing, so you should consider it if you can afford it. After all, U.S real estate offers the following pros:

- Good stability (Zillow predicted that by 2023, house values in the U.S. will have increased by 17.3%.)

- Higher rental yields

- Diversification of your investment portfolio

- Tax deductions and advantages for foreign buyers of real estate. You can make deductions on mortgage repayments, insurance payments, and maintenance. Other deductions include repairs, utilities, and property management. You can also defer taxes when you sell your property. This allows you to reinvest the profits and gains into another similar property.

Investment Strategies for Expats

Consider Local Investment Opportunities

Investment markets in the United States are among the best in history. But, if you live and earn in another country, you should look into local opportunities. Local investment markets and exchanges can provide compelling investment opportunities. This is especially true if you live in a developed area like Canada or Europe.

You can even invest in U.S. assets through local exchanges in some cases. For example, the New York Stock Exchange is part of a NYSE-Euronext company. In 2007, the two exchanges merged, forming the world’s largest group of exchanges.

If the brokerage is not located where you live, you can find a local one that gives you access to global markets. This access includes investments in the United States. If you live in a developing country, you may need more local investment options.

Always Remember The Tax Implications

Exchange rates aren’t the only factors to consider with these types of investments. It would help if you also considered taxes. Contrary to popular belief, US citizens living abroad must file a tax return in the United States. This is true even if they do not owe the IRS any taxes. But, if you have a job at any point, you will probably owe the IRS money even if you live far away.

We know what you’re thinking; it sounds like double taxation, right? It isn’t always so, as some exclusion limits exist to avoid this. (It’s a little complicated, so we recommend finding a tax specialist to help you navigate.)

For example, a tax-simple option for US expats is to open and maintain a brokerage account. Note that this only works if the brokerage and country of residence allow it. You can always use a friend or relative’s address in the US, no matter how unconventional it may seem.

As Reddit user @/pythonfanclub puts it, “it may be weird, but it is often the only way.”

Comment

byu/Bigfoot-Germany from discussion

inUSExpatTaxes

Watch Your Finances, and Don’t Let Exchange Rates Ruin Them

Before investing in foreign investments, consider how you handle money daily.

That begins with your income. If you live abroad and receive your payments in USD through a US bank account, you can manage your money easier. But, if you earn in any other foreign currency, you may have to make some difficult decisions.

Most importantly, try to keep from converting back and forth between dollars and local currency. Exchange rates can add up fast, and paying for foreign exchange twice can be costly.

Bottomline

The investment scope for expats in Europe and the Americas can be challenging. Despite this, the opportunity to build wealth through smart strategies remains present.

Always remember to do your research. Consult with a financial advisor. Also, ensure you understand the tax implications before you make any decisions. With the right approach, you can achieve long-term financial success and security.