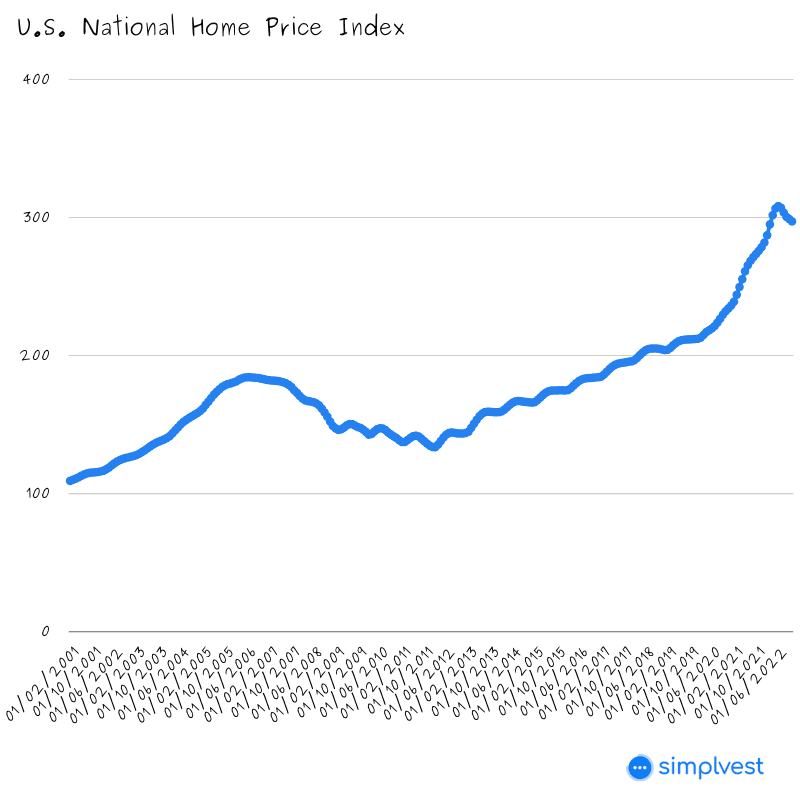

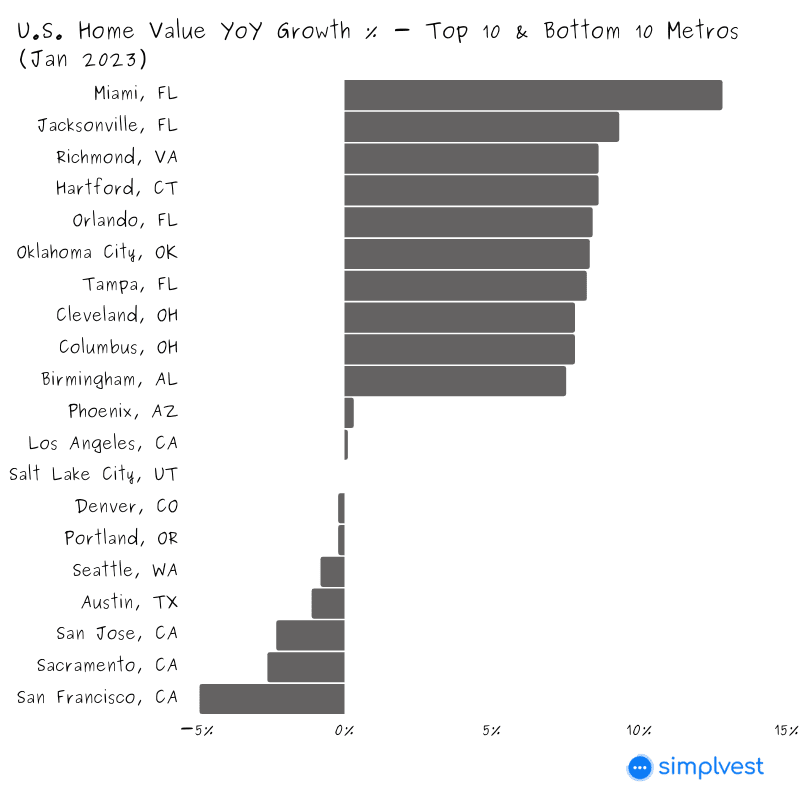

If you’ve been keeping up with the news, you may have noticed that real estate prices and returns have been going down. This is because of factors like the global pandemic, high-interest rates, inflation, and recession. In 2022, the U.S. real estate market was negatively affected by global events and uncertainty. But there is hope! The market is slowly improving and finance experts are optimistic about the future.

Real estate is a wise investment that can generate significant returns. Though markets may fluctuate, it is generally profitable. Compared to other investments, real estate can yield higher earnings, making it an excellent way to save for your future and family. Our article guides beginners on how to invest in real estate.

What is real estate investment?

Real estate investment. What the heck is it, and why on earth would you want to buy in? Let’s dive into the nitty-gritty.

Investing in property means buying real estate with the intention of generating income. When you rent out a property, the money your tenants pay becomes your return on investment (ROI). While there are many strategies for real estate investing, the ultimate objective is to maximise profits and expand your financial portfolio.

Beyond the immediate returns from rental income, investing in property cultivates a wealth-building mentality. By saving for an investment property, you develop strong financial habits that carry over into other areas of your life. This mindset can have a positive impact on your overall financial decision-making.

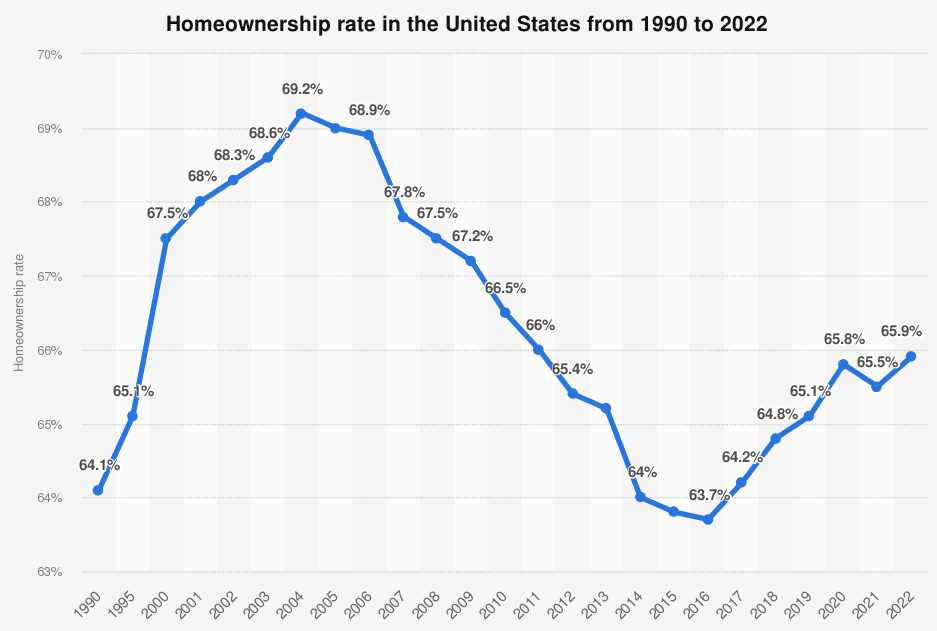

It’s no coincidence that in the US, homeowners’ net worth is over 40 times greater than that of renters (per the Federal Reserve’s 2020 Survey of Consumer Finances). This underscores the fact that investing in property is not only a savvy financial decision but also an effective way to generate intergenerational wealth over time.

“Once the home is purchased you build equity through forced savings and now you are an investor. Behaviourally, those are some wealth-building patterns. Real estate helps establish a structured and disciplined investment plan.”

Sean Wilson, Senior director, product and portfolio and distribution, TIAA

Four Investor Essentials

- Budget – When planning your real estate investment, it’s important to consider your budget and long-term financial goals. Your budget will determine whether you should opt for a mortgage, rental property or other forms of investment.

- Location – Consider the location of the property and your residency status when buying an investment property. This affects the taxes you pay and your eligibility for mortgage loans.

- Contingency and additional requirements – Don’t forget about closing costs (usually 2%-5% of the home’s price) when buying property. These hidden expenses need to be factored into your budget, especially if you’re a non-citizen or non-resident.

- Medium to long-term investment plan – When buying an investment property, you need a plan for how long you’ll keep it and what you’ll do with the income generated from renting it out. This should be considered alongside your budget.

Pro tip: To buy an investment property in today’s housing market, start with a budget and stick with it. Instead of waiting for much lower prices, buying a house should be based on your budget and financial goals.

Forbes Advisor

Top 3 Ways to Invest in U.S. Real Estate Market

1. Buy Your Own Home

As a renter, you’re essentially paying someone else’s mortgage. But don’t let upfront costs dissuade you from investing in your future. While it’s true that renters may pay $800 less per month on average than buyers, the long-term benefits of home equity are undeniable. From potential appreciation in property value to passive income through rentals, owning a property is an investment in your financial future. Just be sure to weigh the risks and rewards and plan carefully for the long term.

Anyone can purchase a home in the U.S., even non-citizens. Paying for a home in full has fewer rules than getting a mortgage, which can be harder for non-residents. Non-citizens may have to follow stricter tax laws when they own property, such as having to pay 15% of the home’s sale price in federal withholding tax.

2. Real Estate Investment Trusts (REITs)

REITs, or Real Estate Investment Trusts (a concept we have previously covered), are like the stock market for real estate. Investors buy shares in a REIT, which uses the money to buy and manage properties like apartments, office buildings, and shopping centres. The rent collected from tenants is then distributed to shareholders as dividends. This way, investors can own a piece of real estate without having to worry about managing it themselves. Plus, REITs are traded on major stock exchanges, making them accessible to all types of investors.

You may also consider public non-listed REITs and Private REITs. With a limited budget, you can invest in fractional shares of REITs via apps like Stash, M1 Finance and Robinhood.

3. Crowdfunding Platforms

| Platform | Fees | Minimum Investment |

| Fundrise | Annual advisory fee of 0.15% to 0.50% | $500 for eREITs |

| RealtyMogul | 1% annual asset management fee for equity investments and a 0.5% annual servicing fee for debt investments | $5,000 |

| Roofstock | 0.5% transaction fee for buying properties and a 10% property management fee for managing the property | Typically $20,000 per property |

| CrowdStreet | 1% to 2% asset management fee and a 0.5% to 1% servicing fee | Typically $25,000 per deal |

| EquityMultiple | 0.5% annual advisory fee and a performance fee of 10% to 20% of profits | Typically $10,000 per deal |

Real estate crowdfunding platforms let you invest in large development projects with others, but be careful because there might be penalties if you change your mind. Check out Fundrise and Crowdstreet amongst others listed below for different investment choices.

As you come to the end of this article, we hope you’re feeling more informed and empowered to make smart financial decisions. Remember, always take the time to thoroughly research any financial platform or investment opportunity before diving in headfirst. By staying patient and informed, you can make the most of your financial journey and reach your long-term goals. So take the first step today and start exploring the many opportunities available to you.

Good luck!!